Category: investments

-

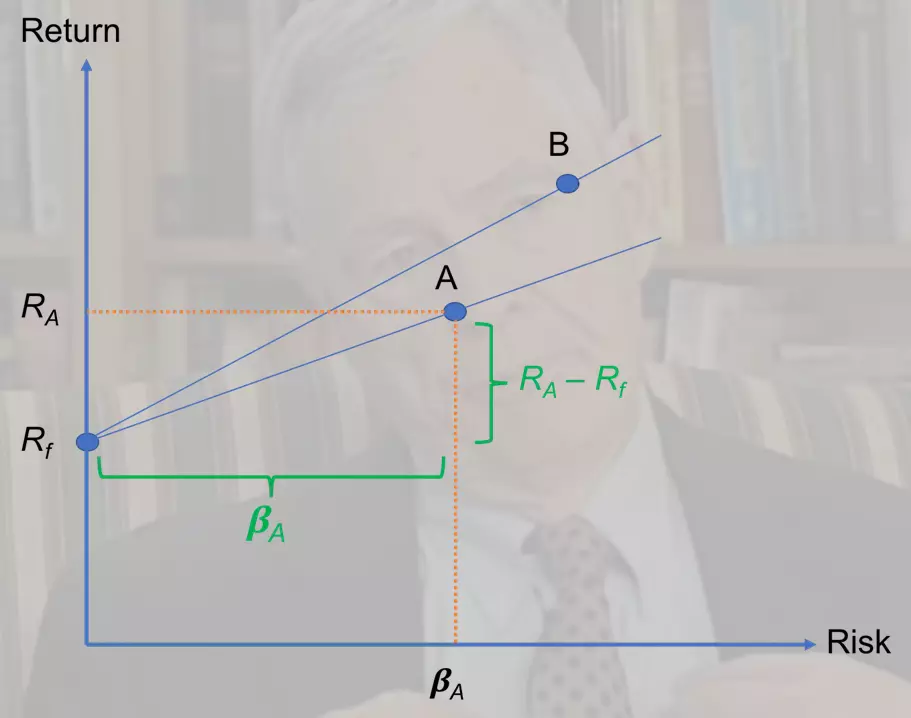

Treynor ratio formula, calculator

Treynor ratio is a popular risk-adjusted performance measure. It was developed by the American economist Jack Treynor in the mid-1960s (you can find the reference for his seminal paper at the bottom of this page). It is a measure of how much “excess return” (i.e., return above the risk-free rate) a security (stock, bond, mutual fund,…

-

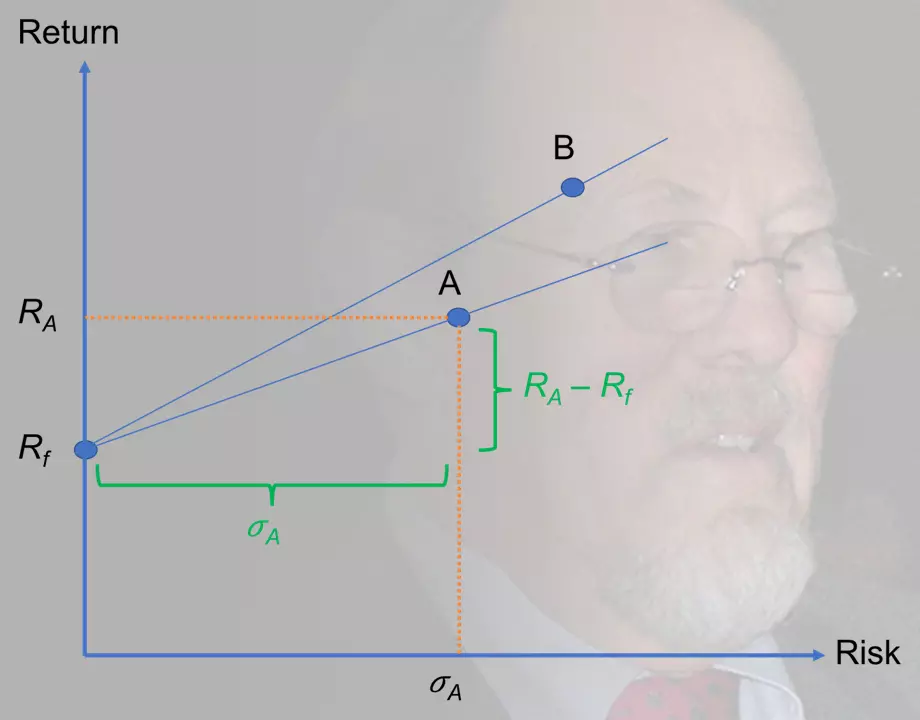

Sharpe ratio calculator, formula

Sharpe ratio is among the most widely used performance evaluation metrics in the fund management industry. It is a reward-to-risk ratio, such that it captures the (excess) return an asset (e.g., stock) generates per unit of (total) risk, which is measured by return volatility. It was developed by Nobel laureate William F. Sharpe, who is…

-

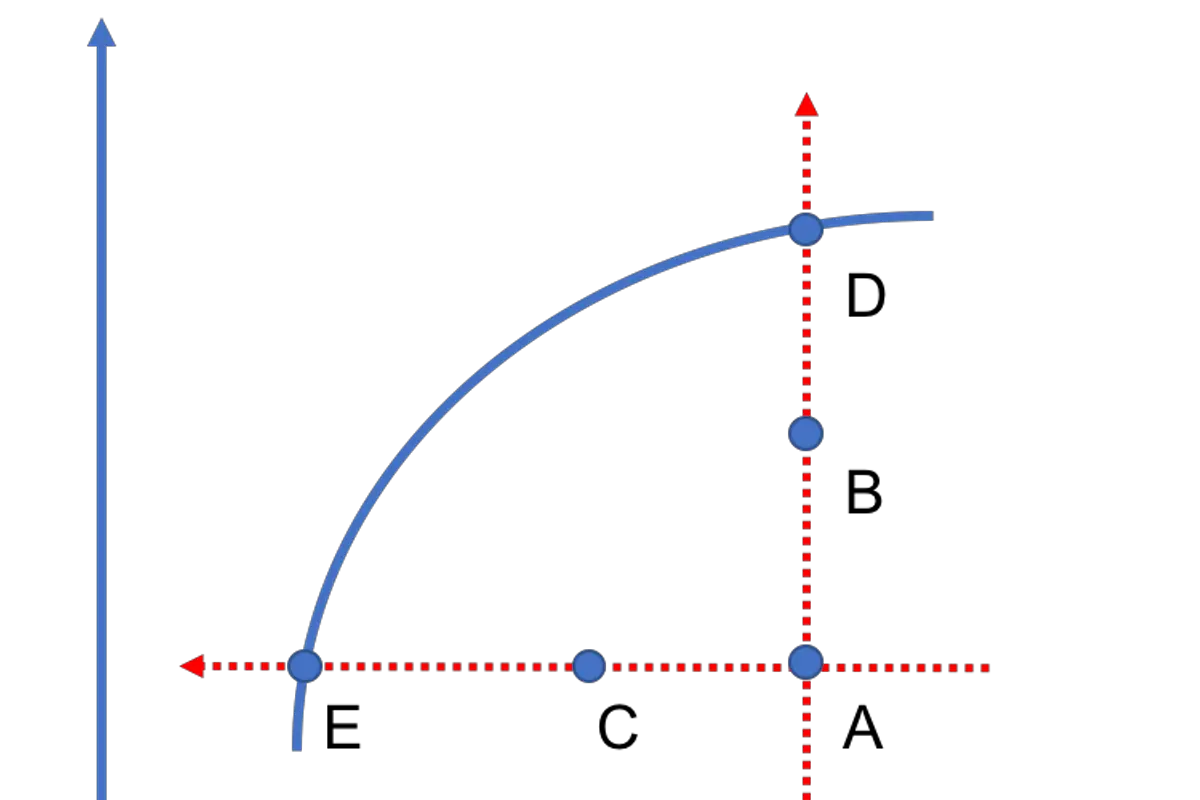

Efficient frontier calculator

In modern portfolio theory, the efficient frontier represents the collection of all efficient portfolios within a market. Efficient portfolios offer the best risk-return tradeoff and, as such, are superior to inefficient portfolios, which are suboptimal. In this lesson, we explain how investors can trace the efficient frontier using mean-variance optimization (the topic of the previous…

-

Mean-variance optimization

According to modern portfolio theory, investors are concerned about the “mean” and “variance” of asset returns, where the former captures the “centrality” and the latter the “spread” (or “riskiness”) of potential returns. As such, investors engage in mean-variance optimization. That is, they seek the portfolios that offer the best tradeoff between risk and return. In…

-

Idiosyncratic risk

What is idiosyncratic risk? It is the type of risk that affects either a single security such as a stock or a small group of securities. This is in contrast to systematic risk, which affects all risky securities in a particular market. The word “idiosyncratic” does not commonly feature in daily language. Many people may…

-

Risk premium definition, calculator

Different stocks offer different levels of expected return. What causes stock A’s expected return to be higher than stock B’s expected return? How does the expected return on a risky asset relate to the risk-free rate of return? In this post, we answer both questions by introducing the concept of risk premium. Jump to: Risk…

-

The opposite of risk averse?

in investmentsAs humans, we have a natural tendency to avoid taking risks when we can, a notion that we refer to as risk aversion. This has the important implication that when we are faced with a choice between a safe payoff and a risky one, we’d opt for the latter only if it entails a sufficient…

-

Fair game meaning

In daily language, “fair game” can be used to suggest that something or someone can be an object of criticism (perhaps because of their behavior or nature). But, what about the meaning of fair game in an economic or financial context? In such a context, a fair game can be defined as a game in…

-

Risk appetite definition

in investmentsIt is clear that some people are more comfortable investing in risky stocks than others. In a similar vein, some firms carry significantly more operational risks and/or financial risks than their competitors. Therefore, the appetite for risk varies across both firms and individuals. But, what is risk appetite? Generally speaking, an individual’s or an organization’s…

-

Sequence of returns risk and why it’s important

in investmentsSequence of returns risk is the risk that your investments will fall sharply in the first 5-10 years of retirement and larger returns will not come soon enough to allow them to recover. This risk is specific to the descent stage of your financial journey, when you are drawing an income from your investments in…