In an initial public offering (IPO), book building is the process in which underwriters (the investment banks managing the issue) elicit indications of interest from institutional investors. Underwriters, then, use the information gathered to “build the book” and establish a demand curve with the ultimate objective of setting an offer price.

Book building is by far the most popular IPO mechanism in the US market, leaving little room for alternative mechanisms such as auctions, fixed-price offerings, and other hybrid methods.

In this post, I’d like to offer a detailed analysis of how the book-building process works for IPO firms.

Contents

Book runner and IPO roadshow

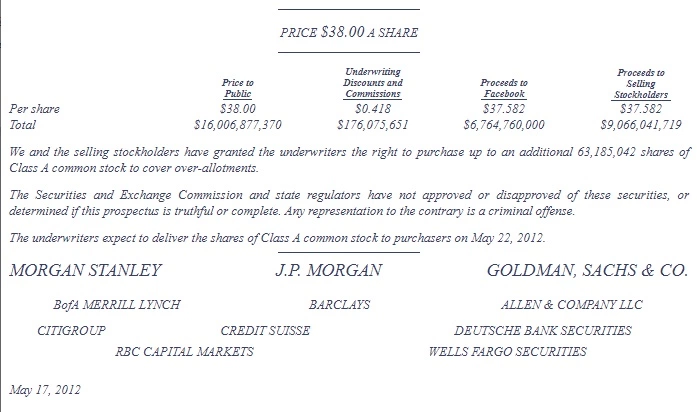

Once a firm decides to go public, it needs to hire a team of investment banks to act as lead managers. If the firm is a well-known company, investment banks normally compete with each other to win the mandate in a process known as the beauty contest. Then, the investment banks that are appointed as lead managers form an underwriting syndicate by inviting other investment banks as either co-managers or syndicate members.

Typically, one of the lead managers acts as a book runner (or book manager). For large IPOs, there may be multiple book runners. The role of the book runner is to manage the book-building process. And, one of the key steps of this process is something called the IPO roadshow. During this event, the issuer and lead managers meet institutional investors and make presentations about the firm’s initial public offering.

Institutional investors play a critical role in the pricing of the issue. The book runner collects nonbinding indications of interest from them. This can be in the form of a series of limit bids. For example, an institutional investor might suggest that they are willing to purchase 1 million shares at a price of $8, and 2 million shares at $7.5. Or, they might say that they would like to purchase, say, 500,000 shares at the offer price (this would be called a strike bid). Clearly, limit bids are more informative than strike bids as they are price sensitive. Therefore, underwriters would welcome institutional investors submitting limit bids when building the book. However, academic work by Cornelli and Goldreich (2003) and Jenkinson and Jones (2004) find that only a small fraction of all bids submitted are price limited.

Setting the offer price and allocating the shares

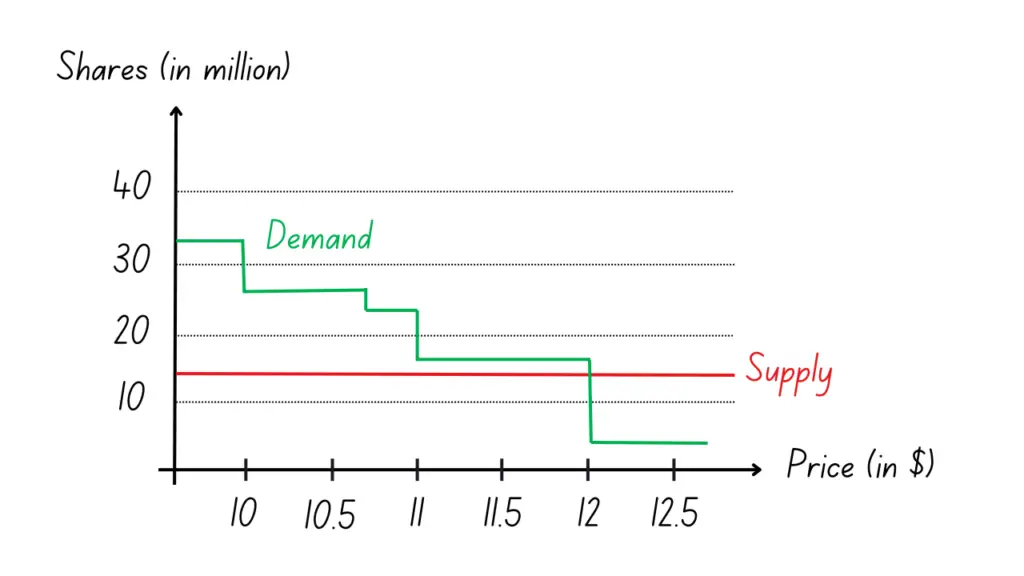

Once the book is built, the book runner would be able to construct a demand curve similar to the one in Figure 1. Note that the supply of shares is fixed as it is equal to the number of shares the firm is selling in its IPO. The demand is determined by the non-binding bids of institutional investors.

Typically, underwriters wouldn’t set the offer price equal to the market clearing price, which is the point where demand equals supply. Instead, they would set a lower price where the number of shares demanded by institutional investors exceeds the number of shares the firm is selling. For instance, for the issue in Figure 1, they would set the offer price below $12.

Obviously, the issuing firm wouldn’t be too happy if the price was set too low because they’d be losing proceeds from the issue. This is called the money left on the table. For instance, if the number of shares sold (i.e., the supply) is 14 million, and the offer price is set to $11.5 instead of $12, the firm would be raising $161 million (= $11.5 * 14 million) instead of $168 million (= $12 * 14 million), which is a loss of $7 million.

Why would then underwriters underprice the issue by selling shares below $12? There are a couple of reasons for that. First, the market usually considers an IPO a success if it experiences a first-day pop on its market debut. This occurs when the shares close above the offer price on the first day of trading. Of course, if the price is set below the market clearing level, this is expected to happen.

Second, underwriters can use this underpricing as a tool for incentivizing institutional investors to reveal any positive information they might possess about the issue. Specifically, as underwriters have discretion over share allocations (and if institutional investors believe issues are underpriced on average), they can reward institutional investors who submit informative bids by allocating them a large fraction of the shares on offer. And, they can penalize institutional investors who don’t contribute to price discovery by giving them few shares in underpriced issues. Indeed, Cornelli and Goldreich (2003) find evidence of that in their data. In contrast, Jenkinson and Johnson (2004) observe that underwriters tend to allocate more shares to institutional investors who are expected to be long-term investors in the issuing firm than to those who would flip the shares soon after the IPO for a quick profit.

In summary, book building is the dominant IPO mechanism in the US and many other markets as well. The process is designed to support price discovery through aggregating information from institutional investors. And, underwriters can use their discretion over share allocations to favor institutional investors who truthfully reveal positive information about the issue and/or who are expected to be long-term shareholders of the IPO firm.

Video summary

Author Bio

Dr. Ufuk Güçbilmez is a senior lecturer (associate professor) in finance at the University of Glasgow Adam Smith Business School. He has previously held positions at the University of Bath School of Management and the University of Edinburgh Business School. He holds a Ph.D. in Finance from the Lancaster University Management School.

His broad areas of research are corporate finance and behavioral finance. His published academic work on IPOs includes:

Leaders and followers in hot IPO markets

What is Next?

If you’d like to learn more about IPO book building, you might find the following articles useful.

Further reading:

Cornelli and Goldreich (2003) “Bookbuilding: How Informative Is the Order Book?” The Journal of Finance, Vol. 58(4), pp. 1415-1443.

Jenkinson and Jones (2004) “Bids and Allocations in European IPO Bookbuilding” The Journal of Finance, Vol. 59(5), pp. 2309-2338.

While you’re here, feel free to browse our free courses and tutorials as well.