On this page, we offer a glossary of investment terms, which includes brief descriptions of the terms that appear repeatedly in our posts. If there is a dedicated (or related) post on a particular term, we provide the link for that post as well.

Contents

A, B, C, D

Adjusted price: It is used for calculating stock returns and takes into account dividend payments and stock splits.

Annuity: It is a stream of cash flows that pays the same amount for a fixed number of periods (typically years).

Arbitrage opportunity: It is an opportunity to generate riskless profits without any need for using your own funds.

Ask price: The minimum price sellers would accept for a security. Also known as the “offer price”.

Beta: It is a measure of an asset’s sensitivity to market movements.

Bid price: The maximum price buyers are willing to pay for a security.

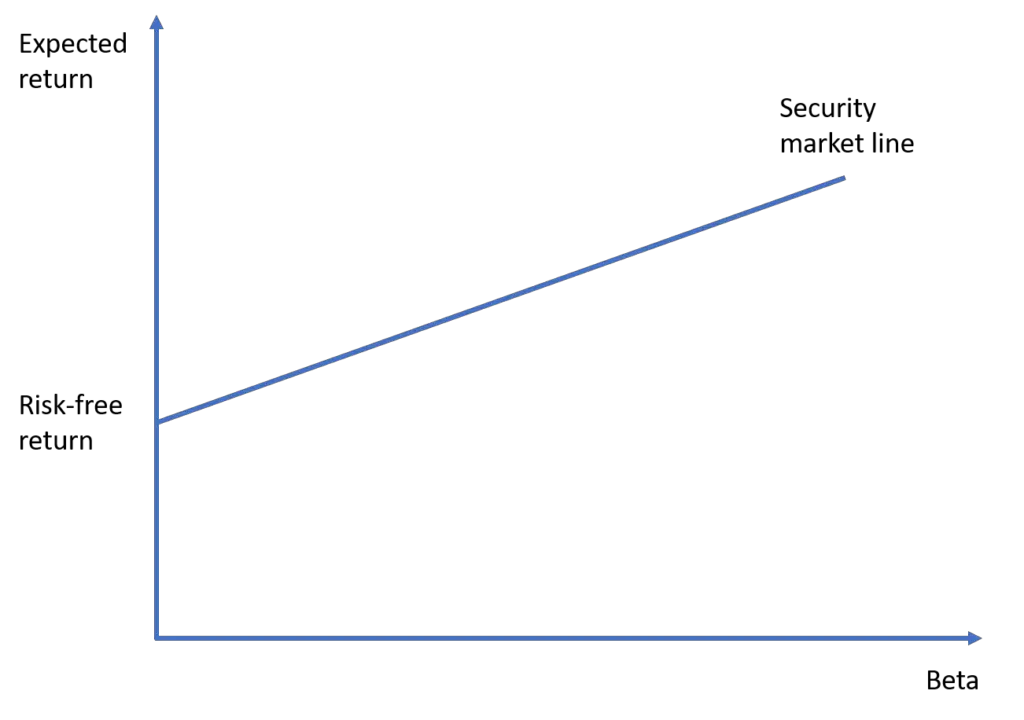

Capital asset pricing model: It is an asset pricing model that predicts a positive, linear relationship between an asset’s expected return and its beta.

Dividend yield: A stock’s dividend yield is equal to the dividend per share divided by the price per share.

E, F, G, H

Excess return: For a risky asset, it is the return that is in excess of the risk-free rate of return.

Fair bet: A type of bet that offers pure risk whereby the expected gain (or loss) is zero. It may be referred to as a fair lottery as well.

FTSE 100: A stock market index that consists of the 100 largest companies listed on the London Stock Exchange by market capitalization. For further info, visit londonstockexchange.com.

Gross return: It is the measure of return before subtracting the initial amount of investment.

Holding period return: It is the return an investor realizes on a specific investment over the entire investment period.

I, J, K, L

Initial public offering: It is the first time a firm sells its equity to the general public.

Inflation: It is the increase in prices observed over time. It drives a wedge between nominal returns and real returns.

Investment: An investment is a sacrifice of current consumption (e.g., saving) in order to boost future consumption.

Limit order: A trade order that is executed only if the price of the security reaches the level specified by the order.

Long position: An investor has a long position in a stock when she holds shares of the stock.

M, N, O, P

Market order: A trade order to buy or sell a security that is to be executed immediately at the current market price.

Net return: It is the measure of return after subtracting the initial amount of investment.

Nominal return: This is the rate of return before accounting for the loss of purchasing power caused by inflation.

Perpetuity: It is a stream of cash flows that pays the same amount indefinitely.

Q, R, S, T, U

Real return: This is the rate of return that is adjusted for the rate of inflation.

Return volatility: It is a measure of risk that is commonly calculated as the standard deviation of returns.

Risk-averse behavior: Such behavior implies a dislike for risk and is characterized by a tendency to refuse pure risks.

Risk-neutral behavior: Behavior that implies a general indifference about pure risks.

Risk-seeking behavior: In contrast to risk-averse behavior, risk-seeking behavior entails the pursuit of risk exhibited by a propensity to accept pure risks.

Risk premium: It is the return a risky asset is expected to generate above the risk-free rate of return.

S&P 500: A stock market index that consists of the 500 largest companies in the US equity markets by market capitalization. For further info, visit spglobal.com.

Sharpe ratio: A popular reward-to-risk ratio used to evaluate investment performance.

Short position: A short position is the mirror image of a long position. It implies short selling an asset.

Short selling: It is the act of selling a security that an investor doesn’t own with an obligation to buy the security back in the future.

Standard deviation: It is the square root of variance, and the standard deviation of returns is a measure of risk.

Stock exchange: It is a venue (New York Stock Exchange, Nasdaq, London Stock Exchange, Shanghai Stock Exchange, etc.) where shares of listed companies can be bought or sold.

Total return: In the context of stock returns, the total return is the sum of capital gains and dividend yield.

Trade order: An instruction to execute a specific trade. This should specify a number of things such as the order type (e.g., limit order), order size, etc.

V, W, X, Y, Z

Variance: It is the sum of squared deviations from the mean value of a distribution.

Weighted average cost of capital: This is the relevant cost of capital when both debt and equity are used for financing a project. It takes into account the tax shield of debt as well.