It’s easy for beginner investors to get confused about bid prices and ask prices (or offer prices). If that’s the case for you, try to remember the following:

Bid is buy, ask is sell

And, this is from the counterparty’s (e.g., dealer) perspective.

So, if you would like to trade, say, a stock, the bid price is the price the market will pay to buy the stock from you. And, the ask price (or the offer price) is the price they will pay to sell the stock to you.

For example, suppose you observe the following quotes posted by a securities dealer for the shares of a stock:

Bid price: $4.1. Ask price: $4.4.

If you wanted to sell your shares, the dealer would buy them from you at $4.1. Conversely, if you wanted to buy some shares, you have to pay $4.4 per share to the dealer.

Contents

Bid-ask spread

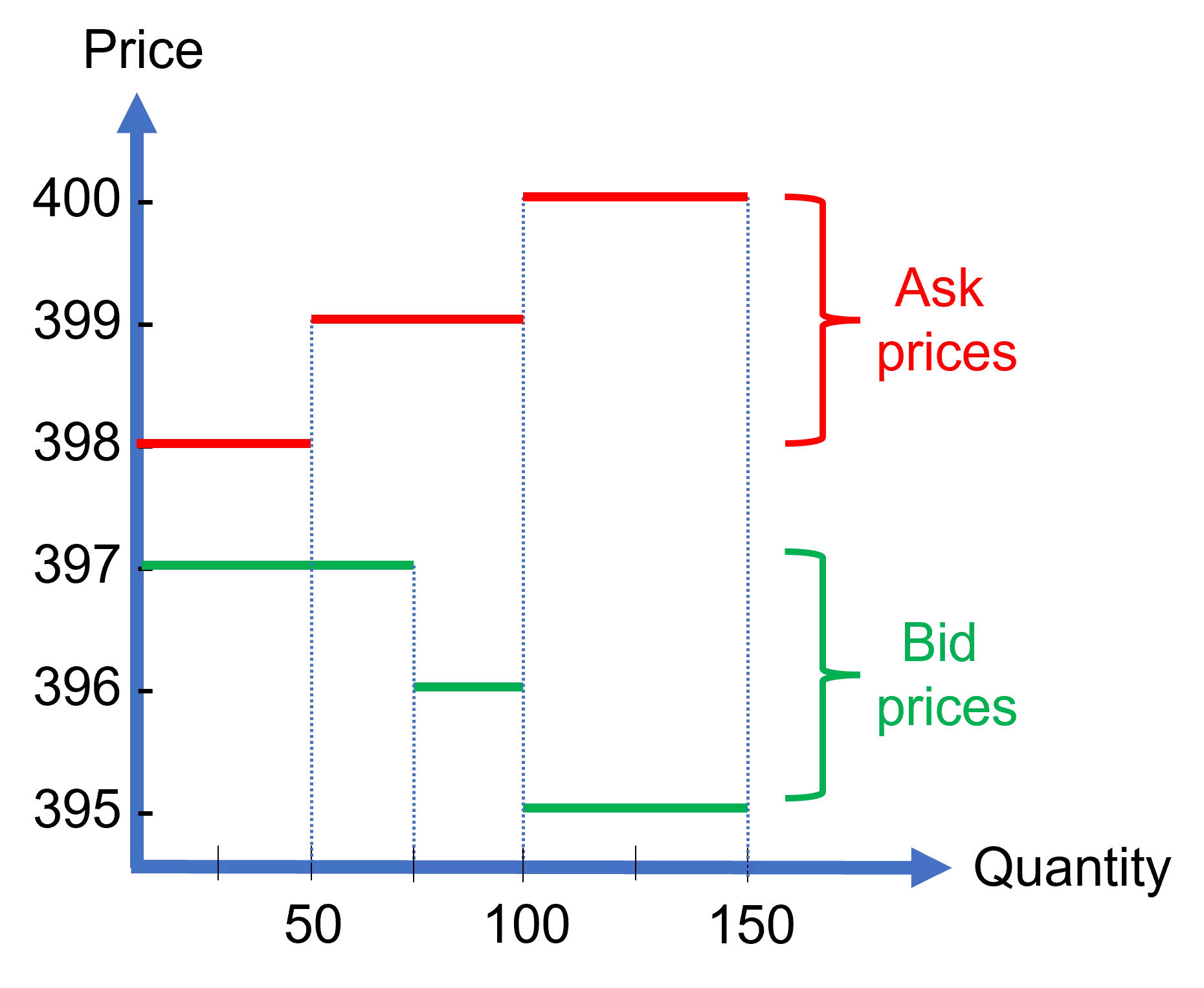

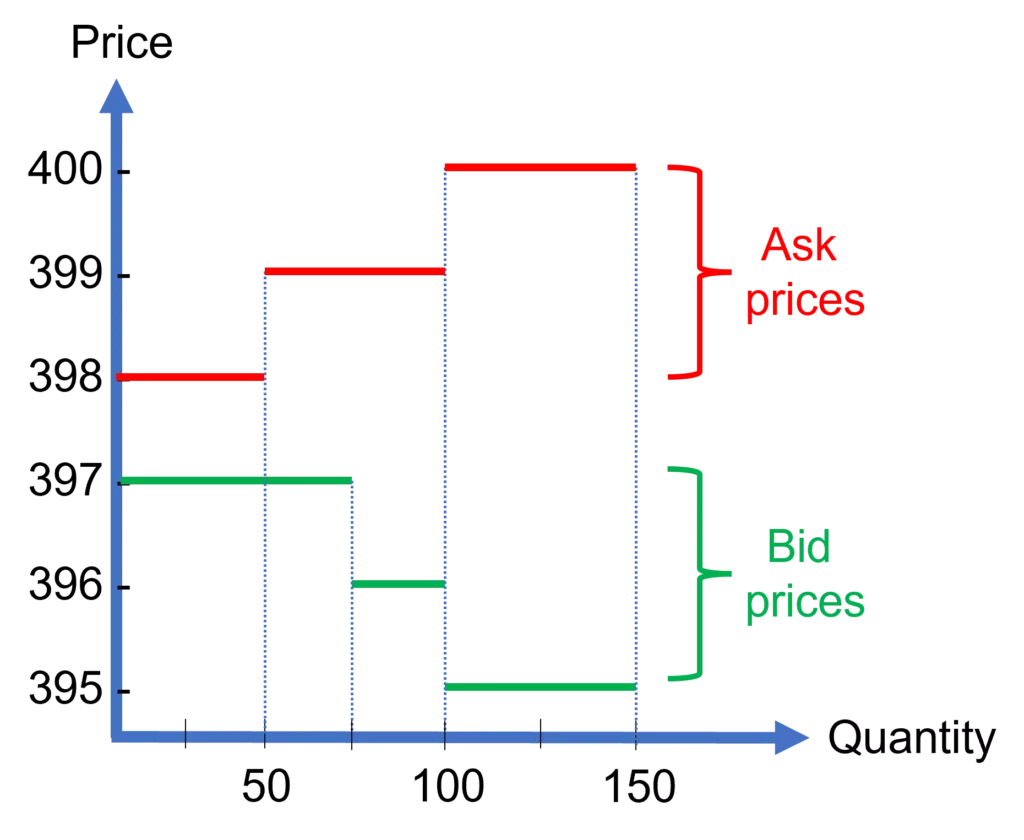

In general, you can think of the market bid price as the highest price buyers are willing to pay, and the market ask price as the lowers price sellers would accept. And, the difference between these two prices constitutes the bid-ask spread, which is an important measure of liquidity. In particular, the lower the spread, the more liquid the asset.

This is illustrated in Figure 1 below. The bid-ask spread is the difference between the lowest ask and the highest bid: $398 − $397 = $1.

Buy cheap, sell high

Dealers (or market makers) make money by selling securities at a higher price than they pay to purchase them. That is why the ask price is always higher than the bid price (see Figure 1 above). Going back to the stock example earlier, the dealer would buy the stock at $4.1 and would sell it for $4.4, making a profit of $0.3 (or 30bp) per share traded.

Conversely, if you bought a share for $4.4 from a dealer and immediately sold it back to them at $4.1, you would lose $0.3 from that transaction, which goes into the dealer’s pocket as their profit. This is known as a round-trip transaction cost. Clearly, the lower the bid-ask spread, the lower the round-trip transaction cost, hence the higher liquidity.

Paying the price…

Bid price vs ask price? One way to recall the meaning of these terms is to understand that when you want to execute a trade, you always transact at the price that is less favorable for you.

If we revisit the earlier example, where the quote for a stock is $4.10 – $4.40, you’d prefer to buy the stock for $4.10 rather than $4.40. But, unfortunately, you’d transact at $4.40, which is the market’s ask price for selling shares of this stock. On the other hand, if you wanted to sell your shares, you’d prefer to sell them for $4.40 instead of $4.10. However, the market is bidding for these shares at $4.10, which becomes your selling price.

Video summary

Summary

In this lesson, we have explained that bid prices represent the buy side of the market and ask prices represent the sell side of the market. We’ve also emphasized that the bid-ask spread, which is the difference between the highest bid and the lowest sell, is an important measure of an asset’s liquidity.

Further reading:

Glosten and Milgrom (1985), “Bid, ask and transaction prices in a specialist market with heterogeneously informed traders“, Journal of Financial Economics, Vol

what is next?

This is the first lesson of our course on the fundamentals of trading.

- Next lesson: We will introduce the concept of a market order and explain how that differs from a limit order.

Feel free to share this post if you enjoyed reading it. Also, if you noticed any errors or have any suggestions/questions, you can get in touch with us here.