Welcome to our online course on investments. This course is suitable for beginner investors as well as finance students studying this topic as part of their undergraduate or postgraduate degrees. The purpose is to give participants a strong background in fundamental topics in investing.

The course is completely free, and you can complete it at your own pace. There is a self-assessment at the end in the form of a quiz. The answers are provided with links to the relevant parts of the material.

Contents

Course structure

The course is structured into four main parts as follows:

- Investment basics

- Investment risk

- Portfolio theory

- Asset pricing and portfolio management

A detailed learning plan, listing all lessons in each part is provided below.

If you’re a total beginner, we suggest you begin with the first lesson in Part I: Gross return vs net return.

If you’re familiar with the basics, you can jump to the first lesson in Part II: Return volatility.

If you’d like to follow a textbook alongside this course, we’d recommend Investments by Bodie, Kane, and Marcus.

Intended learning outcomes

At the end of this course:

- You will be competent in making sophisticated return calculations,

- will have a critical understanding of modern portfolio theory,

- will be able to use CAPM and popular factor models,

- and will be equipped with portfolio evaluation tools.

Assessment

The course has a summative assessment at the end. This is a quiz that you can take in your own time. Further details are provided below.

Detailed learning plan

Part I: Investment basics

We begin the course by teaching how to calculate investment returns. In particular, we explain concepts such as gross return, net return, capital gains, dividend yield, and total return. We also make a distinction between real returns and nominal returns, highlighting the importance of taking inflation into account in return calculations. Then, we move on to return calculations over multiple periods, showing how to calculate holding period returns. Finally, we distinguish between arithmetic average returns and geometric average returns as useful summary statistics.

Part II: Investment risk

In the second part of the course, we hammer home the idea that risk and return are the opposite sides of the same coin. One can’t have one without the other. We begin by distinguishing risk-free assets (e.g., government bonds) and risky assets. For the latter, we explain how to compute expected returns and return volatility. Then, we go into detail in terms of investors’ risk preferences and wrap up by discussing how risk aversion leads to the existence of a risk premium.

Part III: Portfolio theory

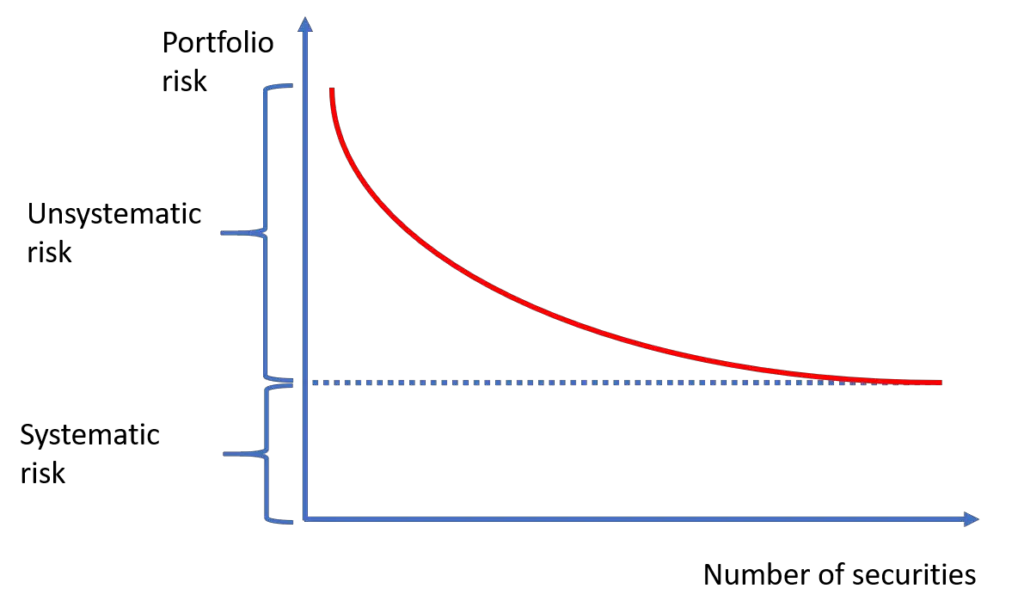

After being equipped with investing basics and a solid understanding of risk, we cover modern portfolio theory in the third part of our course. We begin with teaching how to compute portfolio risk and return. Then, we delve deeper by explaining how investors can construct an efficient frontier through mean-variance optimization. After that, we show how to locate the optimal risky portfolio and the minimum-variance portfolio on the efficient frontier. We conclude this by explaining the distinction between market risk and firm-specific risk.

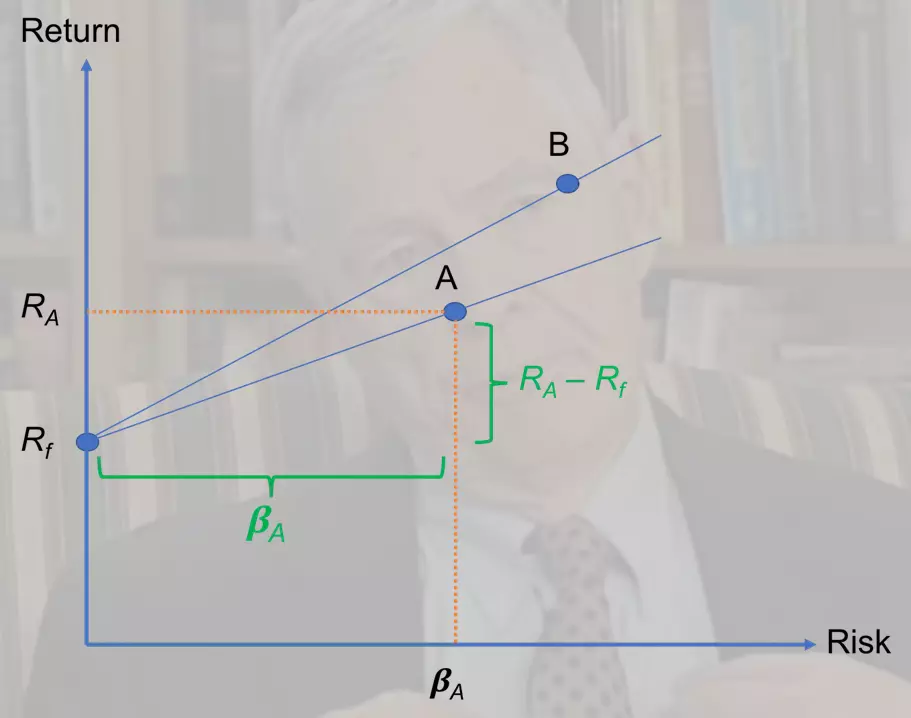

Part IV: Asset pricing and portfolio management

In the final part of the course, we discuss how asset prices are determined in a market with many investors. This discussion leads to two very popular asset pricing models: CAPM and APT. Then, we move on to the topic of portfolio management and teach widely-used risk-adjusted performance measures such as the Jensen’s alpha, Sharpe ratio, and Treynor ratio.

Quiz

Once you complete the course, we’d recommend you take our investment quiz to test your learning. The quiz consists of 10 multiple-choice questions. Answers are provided, including links to the relevant course material.

Here is the link for the investment quiz:

Self-assessment for the investments course

Other courses and tutorials

We offer a range of courses and tutorials on our website. Apart from our investments course, you might enjoy our courses on fundamentals of trading and tokenomics.

We also offer a tutorial on analyzing stock returns. In this tutorial, we provide step-by-step guides on topics such as plotting histograms of stock returns and computing the correlation coefficient between two stocks.

Access to our courses and tutorials is free of charge.

If you’ve got any questions about our content, you can write to us here.