As humans, we have a natural tendency to avoid taking risks when we can, a notion that we refer to as risk aversion. Specifically, when faced with a choice between a safe payoff and a risky one, we’d opt for the latter only if it entails a sufficient risk premium, which is our reward for bearing risk. But, do we always act in a risk-averse manner? And if not, what is the opposite of risk averse?

Theoretically, we can come up with three broad types of risk attitudes:

- Risk averse

- Risk neutral

- Risk seeking

Therefore, the opposite of risk averse is risk seeking. This type of behavior entails a yearning for risk even if it may result in an inferior outcome than a safer choice in expectation. In the rest of this lesson, we further elaborate on how exactly we differentiate risk-seeking individuals from risk-averse ones and discuss how a person’s risk preferences affects the shape of their utility function. You can also find a video summary at the end.

Contents

Risk-averse vs risk-seeking behavior

In the previous lesson, we introduced the concept of a fair game. A fair game is typically risky, but playing such a game would result in neither a loss nor a profit in expectation.

Intuitively, risk-averse individuals would not like such games because they involve risk without any reward. Therefore, they would refuse to play them. In contrast, risk-seeking people would happily accept fair games as they crave risk exposure, and such games provide that without an expected loss.

Note that this doesn’t mean that risk-seeking individuals would just take any risk. They would, of course, reject risky prepositions that entail a high degree of expected losses. And, a person’s risk appetite can vary across circumstances and over time.

Finally, a risk-neutral individual would be indifferent between accepting and rejecting a fair game.

Risk preferences and utility function

An individual’s utility function of wealth u(w) measures the utility (or happiness) the individual receives for different levels of wealth w. Of course, we expect the utility to increase with wealth, such that the wealthier the individual gets the happier she becomes.

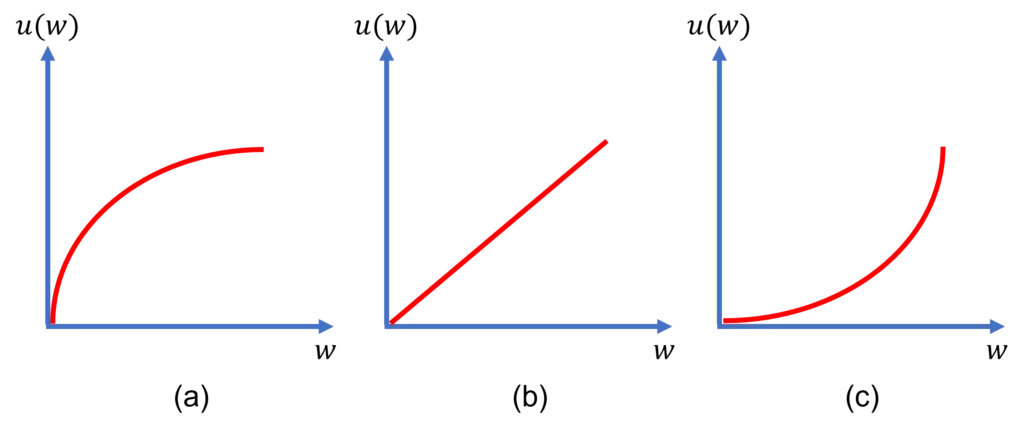

There is an inherent link between the shape of an individual’s utility function and her risk preferences. This is illustrated in Figure 1 below. The shape of the utility function is concave for a risk-averse person. This is because a risk-averse individual prefers the expected value of a gamble to the gamble itself, and that preference implies a concave utility function mathematically. Based on similar arguments, the utility function is linear for a risk-neutral person, and convex for a risk-seeking one.

A risk-averse person has a concave utility function as in panel (a), a risk-neutral one has a linear utility function as in panel (b), and a risk-seeking one has a convex utility function as in panel (c).

Video summary

Summary

In financial economics, there are three broad categories of risk attitudes. First, we have “risk-averse behavior”. This can be thought of as a general dislike for risk. The utility function is concave for individuals who exhibit such behavior. Then, we have “risk-seeking behavior”. This is the opposite of being risk averse and implies a desire for bearing risk. The utility function associated with this type of behavior is convex. Finally, we have risk-neutral behavior, which is characterized by indifference toward risk. This results in a linear utility function.

| Preferences | Fair game | Utility function |

|---|---|---|

| Risk averse | Reject | Concave |

| Risk neutral | Indifferent | Linear |

| Risk seeking | Accept | Convex |

Further reading:

Zaleskiewicz (2001), “Beyond risk seeking and risk aversion: personality and the dual nature of economic risk taking“, European Journal of Personality, Vol. 1(S1), pp. S105-S122.

What is next?

This lesson is part of our free course on investments.

- Next lesson: We define the risk aversion coefficient, differentiating between absolute risk aversion and relative risk aversion.

- Previous lesson: We introduced the concept of a fair game using the coin toss game (50-50 chances of winning and losing a fixed amount) as an illustrative example.

If you like reading our content, please spread the word to give exposure to our courses and tutorials. If you have got any questions or comments, you can reach us here.