In this lesson, we explain what is meant by the minimum variance portfolio (MVP), derive its formula for the two-asset case, and provide an online calculator as well.

You can also check out our video tutorial to learn how to find the position of the MVP on the efficient frontier using Excel’s solver tool. And, you can download the Excel template we use in this tutorial.

Contents

What is the minimum variance portfolio?

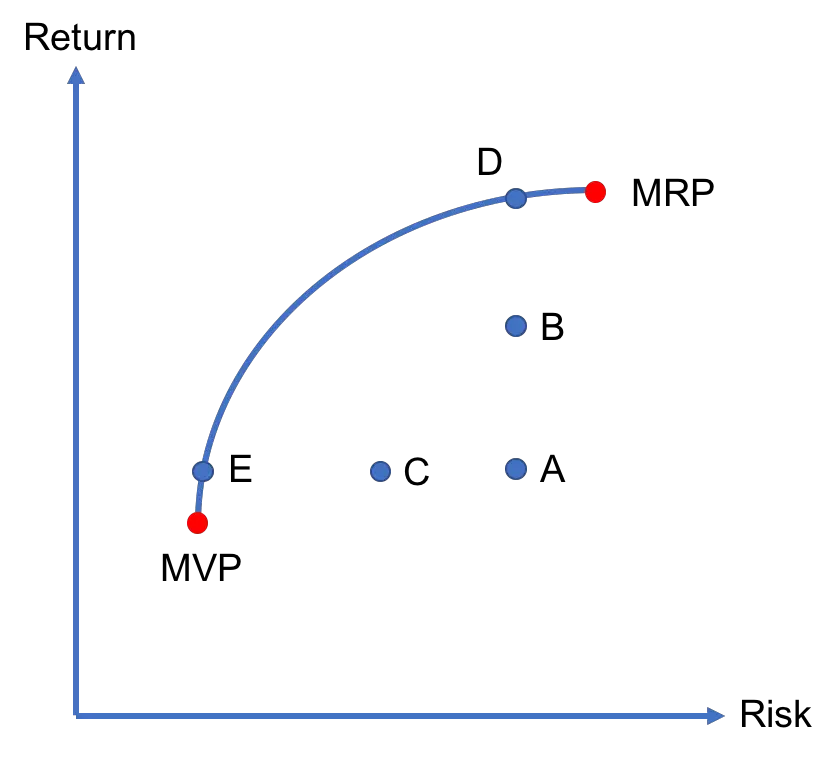

In a market with multiple risky assets, the minimum variance portfolio is a particular combination of those assets that yields the minimum volatility. To be more specific, consider the market depicted in Figure 1. Here, the blue curve represents the efficient frontier. That is, all portfolios that lie on it are efficient portfolios (e.g., D and E) whereas those that lie below it are inefficient portfolios (e.g., A, B, and C). In this context, the leftmost portfolio on the efficient frontier is the MVP. This is because it is the efficient portfolio that has the lowest level of risk. The MVP appeals to investors that are particularly risk-averse.

Formula for the two-asset case

Let’s suppose we have two risky assets: A and B. Then, we can write the portfolio variance as:

where σA and σB are the standard deviations of returns (i.e., return volatility) for these two assets, σAB is the covariance of returns, and ωA and ωB are the investment weights. Given that ωA + ωB = 1 (i.e., we’re fully invested in these two assets), we have ωB = 1 − ωA. So, we can rewrite the portfolio variance as follows:

We’d like to find the investment weight ωA* that yields the minimum variance portfolio:

We can find that by taking the derivative of portfolio variance with respect to ωA and setting it equal to zero:

Solving for the optimal investment weight ωA* yields the minimum variance portfolio formula:

Remember that the covariance between the returns of two assets σAB can also be written as ρABσAσB, where ρAB is the correlation coefficient. So, we can write the formula using the correlation coefficient instead of covariance as well:

Minimum variance portfolio calculator

Three inputs are needed to use our minimum variance portfolio calculator:

- The standard deviation of returns on the 1st asset in percentages (σA ≥ 0).

- The standard deviation of returns on the 2nd asset in percentages (σB ≥ 0).

- The correlation coefficient between the returns of the two assets (ρAB), which needs to be between −1 and +1.

Note that if the covariance between the returns of the two assets (σAB) is known/given instead of the correlation, the latter can be easily calculated as: ρAB = σAB / (σAσB).

Once the inputs are entered, the calculator gives the optimal investment weight for each asset (ωA* and ωB*), and the variance (σMVP2) and standard deviation (σMVP) of the portfolio that has the minimum variance. It is worth highlighting that either ωA* or ωB* can be negative, in which case short selling is implied.

To illustrate the use of the calculator, try the following example. If asset A has a volatility of 20%, asset B has a volatility of 10%, and the correlation coefficient between the returns of A and B is −0.25, then investing 25% in A and 75% in B yields the minimum variance portfolio, which has a variance of 62.5 and volatility of 7.9%.

Video tutorial and excel template

The video tutorial below explain how to locate the minimum variance portfolio on the efficient frontier plot in Excel. You can also download the excel spreadsheet used in this tutorial here.

Summary

One of the most significant insights of modern portfolio theory is that investors can reduce risk through diversification. In this lesson, we explained the concept of the (global) minimum variance portfolio. For any given number of assets, this portfolio has the lowest risk where risk is measured in terms of variance.

Further reading:

Clarke, de Silva, and Thorley (2006), “Minimum-Variance Portfolios in the U.S. Equity Market“, The Journal of Portfolio Management, Vol. 33(1), pp. 10-24.

What is next?

This lesson is part of our free course on investments.

- Next lesson: We will show how to obtain a capital allocation line by combining the risk-free asset with a risky asset.

- Previous lesson: We discussed what is meant by an efficient frontier, distinguishing between efficient portfolios and inefficient ones.

If you’ve got any feedback for us, you can reach us here. And, if you enjoy reading our content, you can help us by spreading the word on social media and within your social networks.