Idiosyncratic risk is the type of risk that affects either a single security such as a stock or a small group of securities. This is in contrast to systematic risk, which affects all risky securities in a particular market.

The word “idiosyncratic” is not commonly used in daily language. ln fact, idiosyncratic risk is often misspelled as “indiosyncratic risk” or “idosyncratic risk”. The dictionary meaning of the word is “an individualizing characteristic or quality” (source: Merriam-Webster dictionary).

So, if you take a particular company, say, Tesla as an example, Elon Musk’s tweets about the company might have an impact on the value of Tesla shares but are unlikely to have any effect on most other firms. In other words, Musk’s tweets would be a source of idiosyncratic risk for the Tesla share price but would not cause any systematic risk for the market.

Contents

Total risk = systematic risk + idiosyncratic risk

The variance of returns σ2 is a popular measure used to capture the riskiness of a stock or any other risky asset. It has its roots in modern portfolio theory, which assumes that investors engage in mean-variance optimization when selecting portfolios.

According to the capital asset pricing model, σ2 represents a security’s total risk and can be decomposed into two parts as follows:

where βi is the beta of the security, σ2m is the variance of market returns, and σ2ei is the variance of residual returns (i.e., returns not explained by the market). According to this decomposition, the first term represents the portion of total risk that is due to systematic risk, and the second term captures the portion that is due to idiosyncratic risk.

Synonyms for idiosyncratic risk

There are a number of terms academics and practitioners use when referring to idiosyncratic risk. These synonyms include:

- Firm-specific risk

- Unsystematic risk

- Diversifiable risk

- Unique risk

All of these synonyms reflect the ideas that this type of risk (i) relates to firm-specific events such as the change of a CEO, the loss of a lawsuit, or the approval of a patent; and (ii) is diversified away in a large portfolio as the effects of positive news about some stocks offset negative news about other stocks within the portfolio.

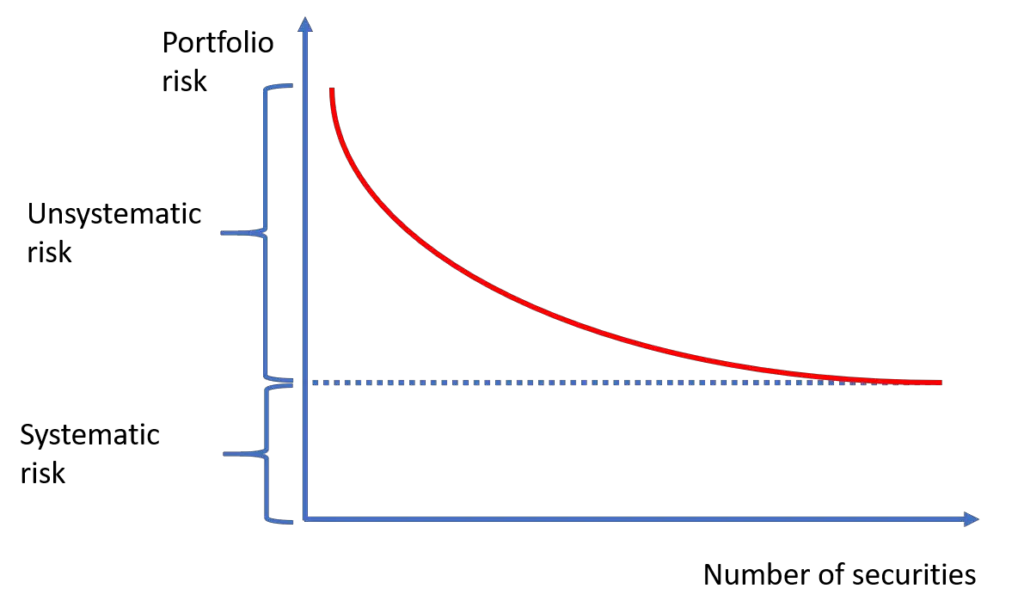

This is illustrated in the figure below where portfolio risk goes down as unsystematic risk is eliminated through the addition of securities into the portfolio. However, the portion of risk due to systematic risk stays put regardless of the size of the portfolio.

Video summary

Summary

Broadly speaking, there are two types of risk investors must be aware of. The first type of risk affects most firms in an economy and is called systematic risk. This type of risk cannot be eliminated through portfolio diversification.

In this post, our focus was on idiosyncratic risk, which arises primarily from firm-specific events, and, thus, can be diversified away when an investor holds a large number of securities in their portfolio. For example, while changes in energy prices would likely affect most firms and would be a source of systematic risk, the risk that a particular biotechnology firm would not get a patent approved would be an example of idiosyncratic risk.

What is next?

This lesson is part of our free course on investments.

- Next lesson: We will move on to the capital asset pricing model (CAPM), which is a widely-used asset pricing model.

- Previous lesson: We defined the market portfolio as a value-weighted portfolio of all risky assets in an economy.

If you would like to give us any feedback on our content, you can contact us here.