Tag: capm

-

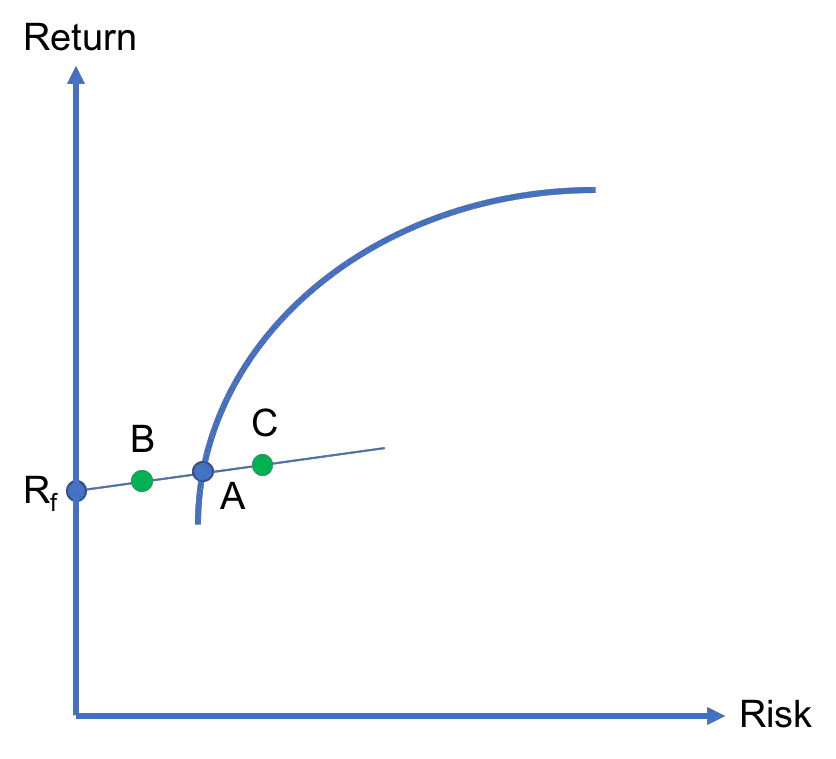

Capital allocation line

When a risk-free asset exists in an economy, investors can add that asset to their portfolios if they wish so. In the risk-return space, the combination of the risk-free asset and any risky asset is a straight line. This line is called the capital allocation line as it shows how an investor’s capital is allocated…

-

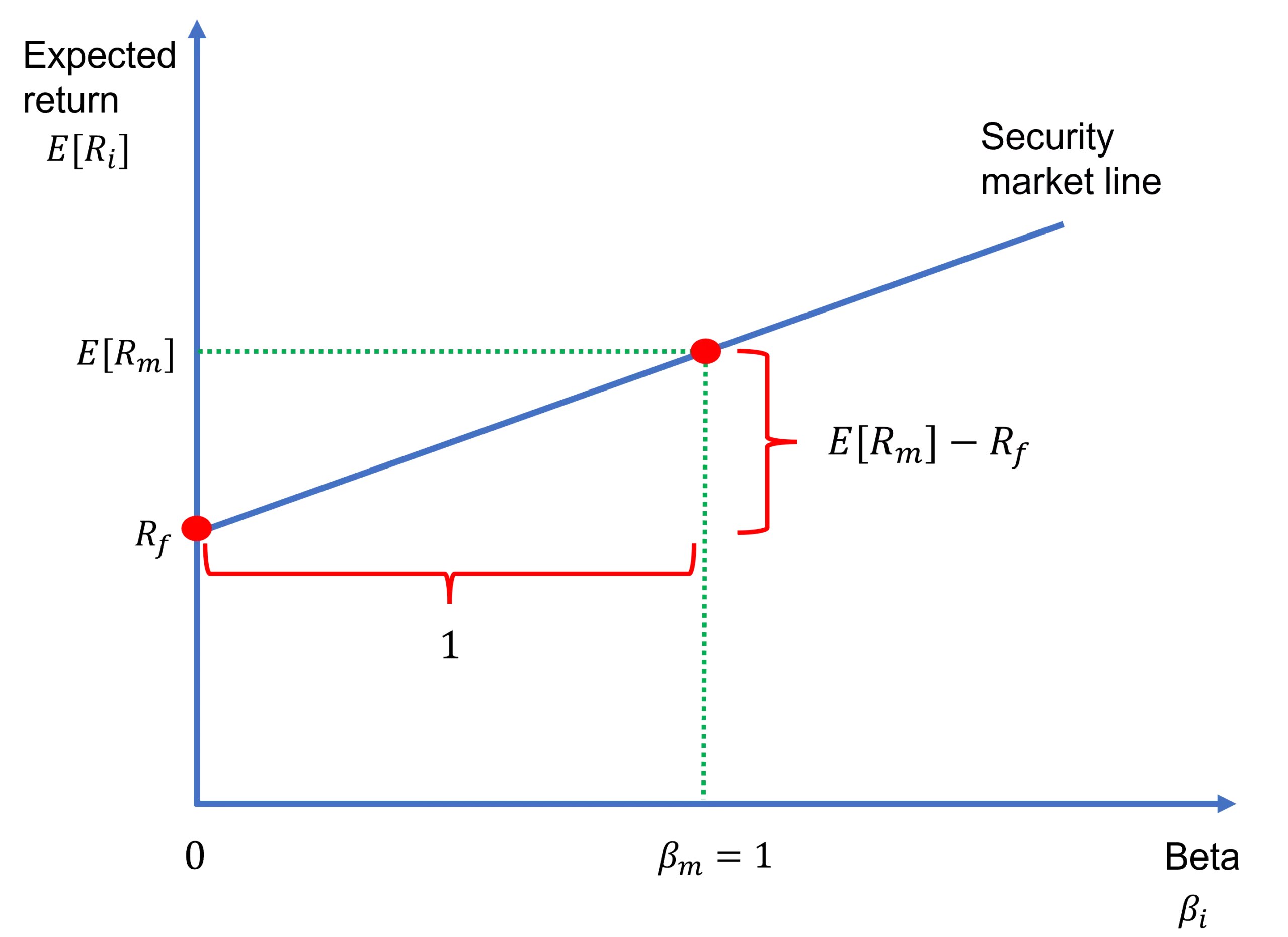

Security market line

The security market line (SML) depicts the linear relationship between expected return and systematic risk, which is measured by beta, according to the capital asset pricing model (CAPM). Specifically, the equation of the security market line is nothing but the CAPM formula: where E[Ri] is the expected return on asset i, E[Rm] is the expected…

-

Market portfolio

We have so far learned how to calculate the risk and return of portfolios and how to trace an efficient frontier through mean-variance optimization. It is now time to introduce a special portfolio that will play a significant role when we discuss the CAPM: The market portfolio. What is the market portfolio? The market portfolio is the…

-

Capital asset pricing model (CAPM)

The capital asset pricing model (or CAPM) is among the most widely-used asset pricing models by stock analysts and portfolio managers. Its popularity arises from its simplicity and elegance. Analysts and investors can use it to forecast returns or to estimate the cost of equity. In this lesson, we explain this model and its assumptions.…

-

Idiosyncratic risk

Idiosyncratic risk is the type of risk that affects either a single security such as a stock or a small group of securities. This is in contrast to systematic risk, which affects all risky securities in a particular market. The word “idiosyncratic” is not commonly used in daily language. ln fact, idiosyncratic risk is often…

-

What is the risk-free rate?

The risk-free rate is the rate of return earned on a risk-free asset. While returns on risky assets such as stocks are uncertain, the key distinction of the risk-free rate of return is that we know its exact value at the time of investment. For example, we may expect a stock to yield 8% over…

-

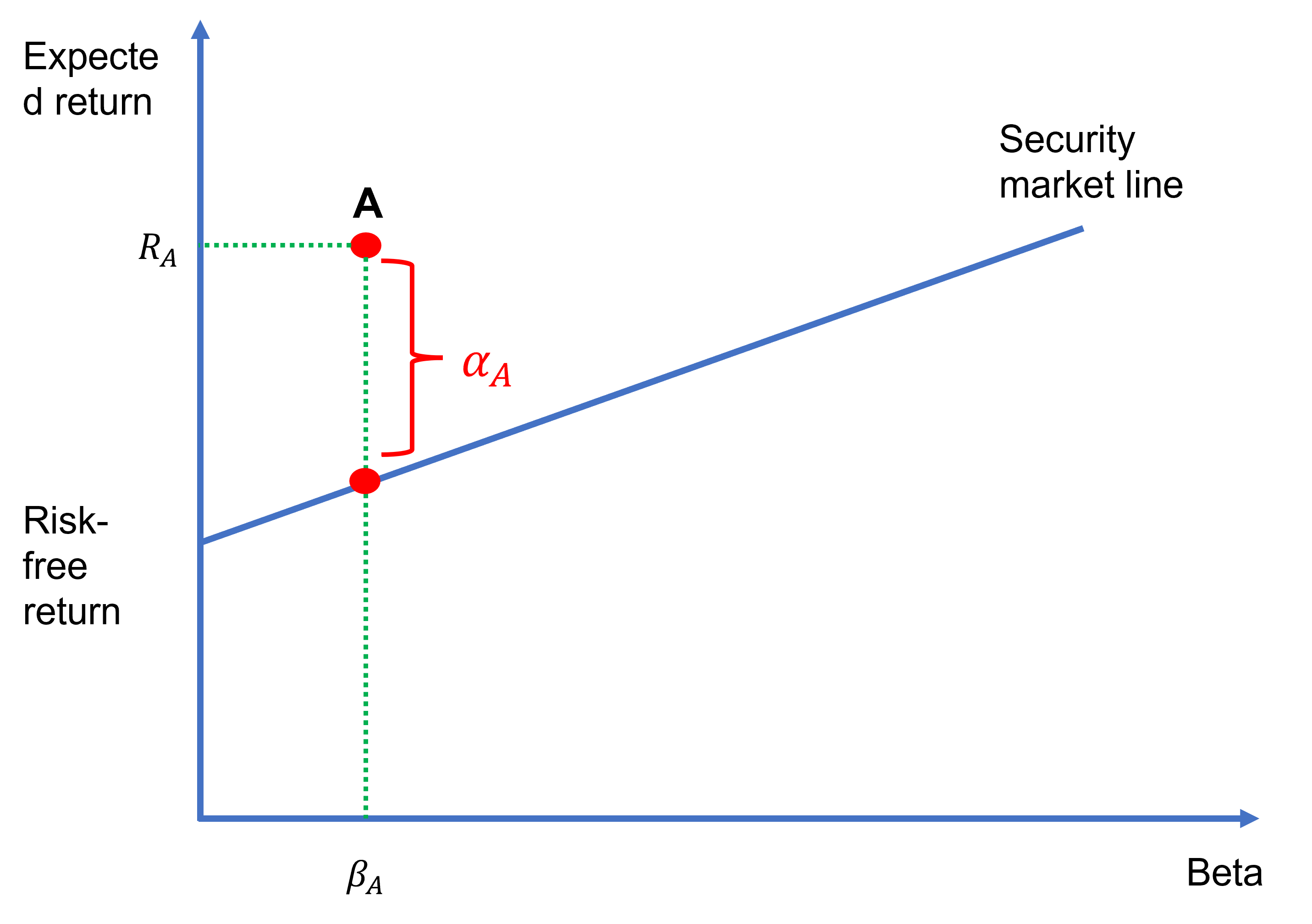

Jensen’s alpha formula and calculator

Jensen’s alpha is a popular performance evaluation metric, which was developed by the American financial economist Michael Jensen in the late 60s. It is a risk-adjusted performance measure (other examples include the Sharpe ratio and Treynor ratio) and is theoretically linked to the capital asset pricing model (or the CAPM). Jensen’s alpha formula We can…

-

Investments quiz – Test your knowledge!

in investmentsThis investments quiz aims to test your knowledge of the material covered in our free investments course. The quiz is a multiple-choice test. It consists of three sections: The solutions are provided at the bottom of this page. Section A: Return calculations 1. You buy a single share of a stock for $10. After three…

-

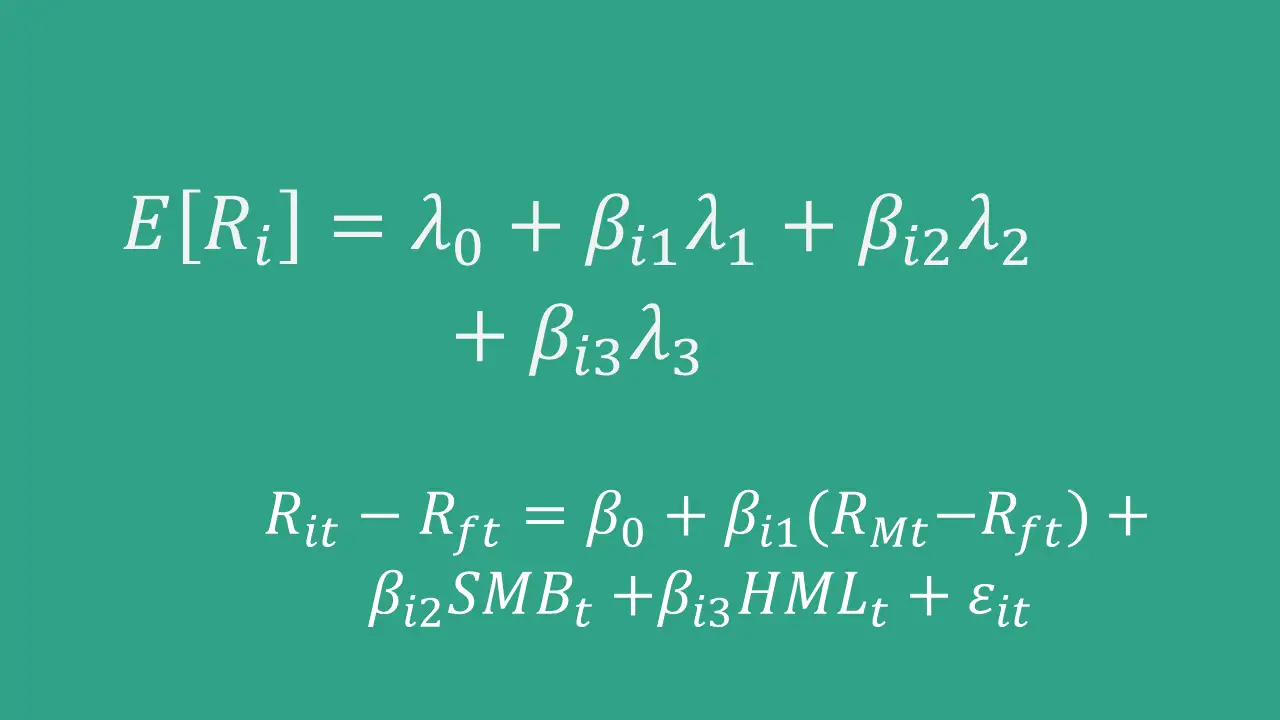

Arbitrage pricing theory (APT)

Arbitrage pricing theory (APT) is an asset pricing model developed by the American economist Stephen Ross in the mid-1970s. While the capital asset pricing model (CAPM) posits a single systematic risk factor, which is the market risk, arbitrage pricing theory accommodates multiple risk factors. As such, APT has been the driving force behind the growth of multi-factor…