Category: calculators

-

Total return formula and calculator

In the second lesson of our investments course, we’ll be learning about a stock’s total return and its two components: capital gains and dividend yield. Total return formula Imagine that you bought a stock a few months ago for $10 per share and the current share price is $12. Based on what we learned in…

-

Gross return vs net return

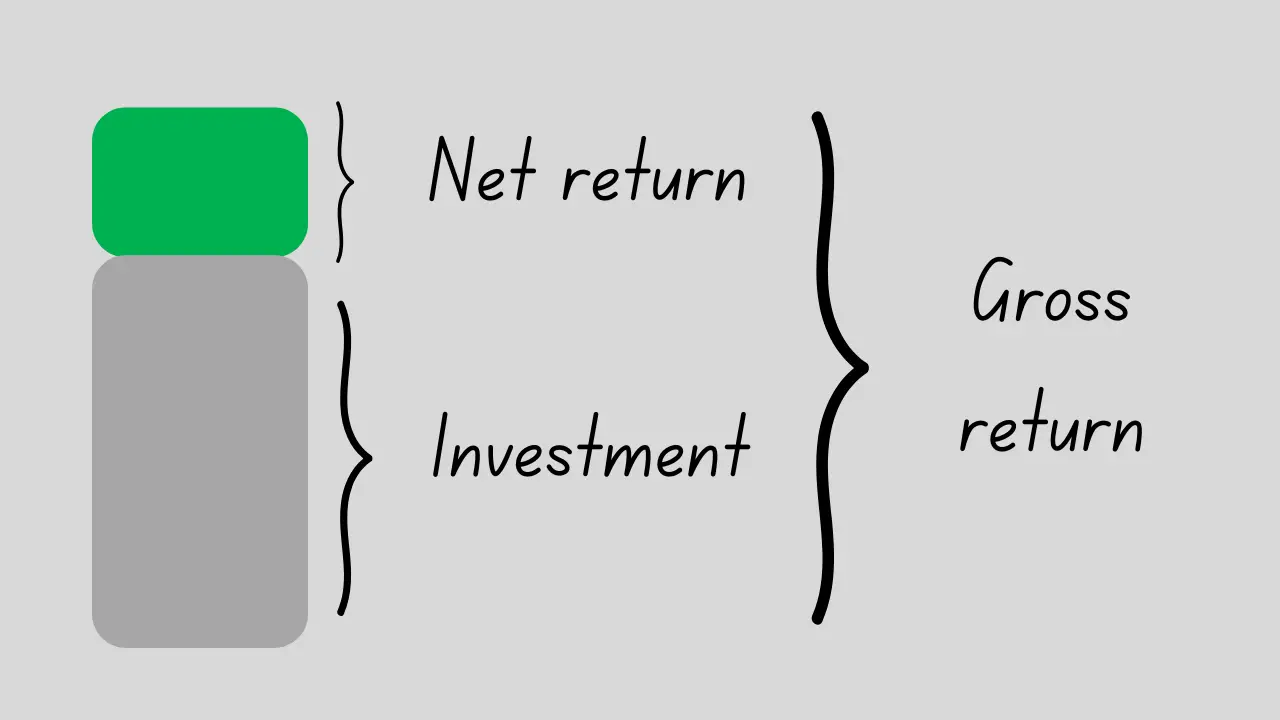

We begin our investments course by introducing fundamental return calculations. It’s essential to grasp the difference between gross returns and net returns from the outset. We define these two fundamental concepts below with practical examples. You might find the video tutorial at the end useful as well. Gross return Let’s suppose you bought shares of…

-

Portfolio risk calculator and formula

We often say that risk and return are two sides of the same coin. So, when assessing the performance of a portfolio, we need to consider its risk as well as its return. In the previous lesson, we focused on portfolio return. Now, we turn our attention to portfolio risk. Portfolio risk calculator You can…

-

Capital asset pricing model (CAPM)

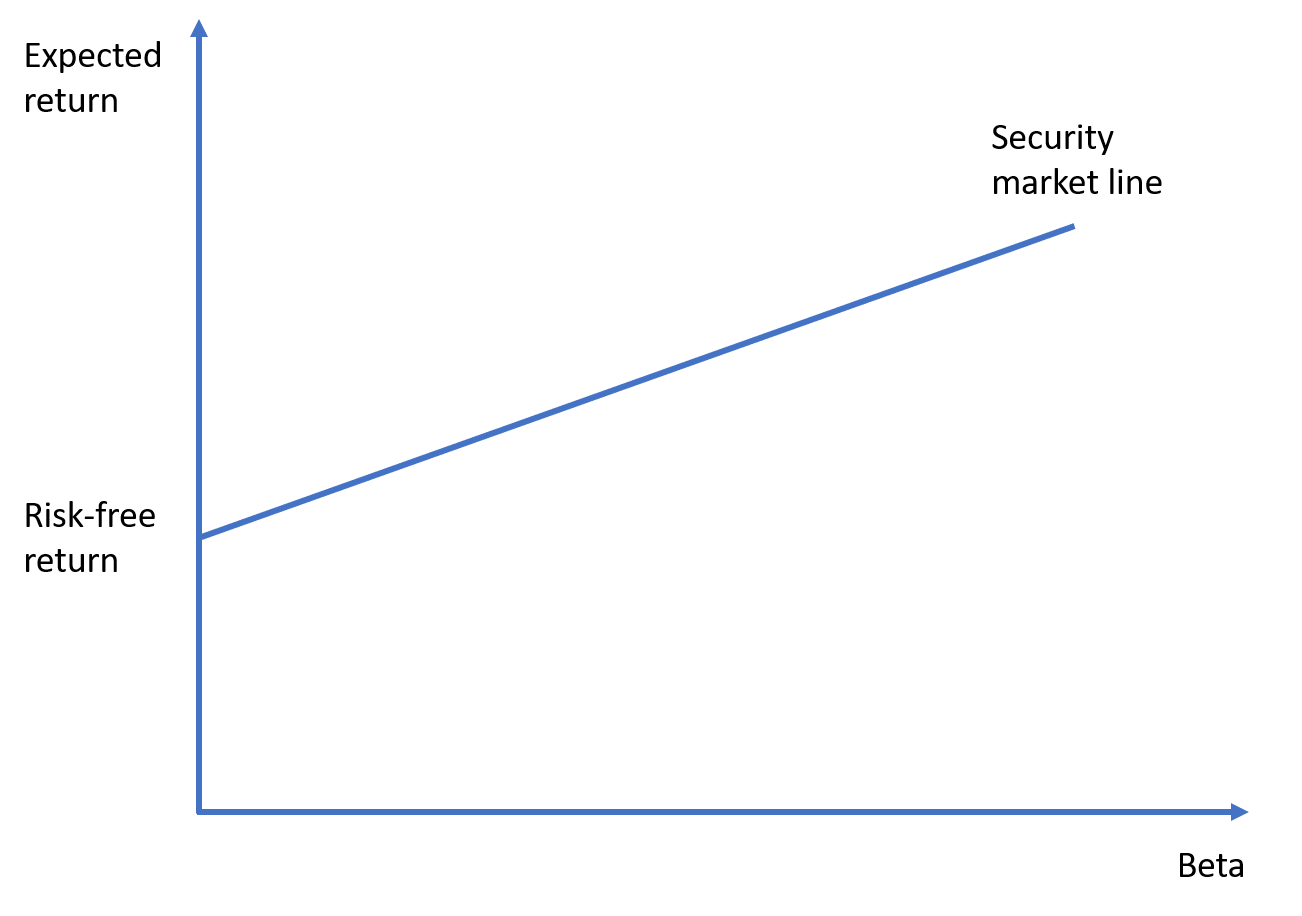

The capital asset pricing model (or CAPM) is among the most widely-used asset pricing models by stock analysts and portfolio managers. Its popularity arises from its simplicity and elegance. Analysts and investors can use it to forecast returns or to estimate the cost of equity. In this lesson, we explain this model and its assumptions.…

-

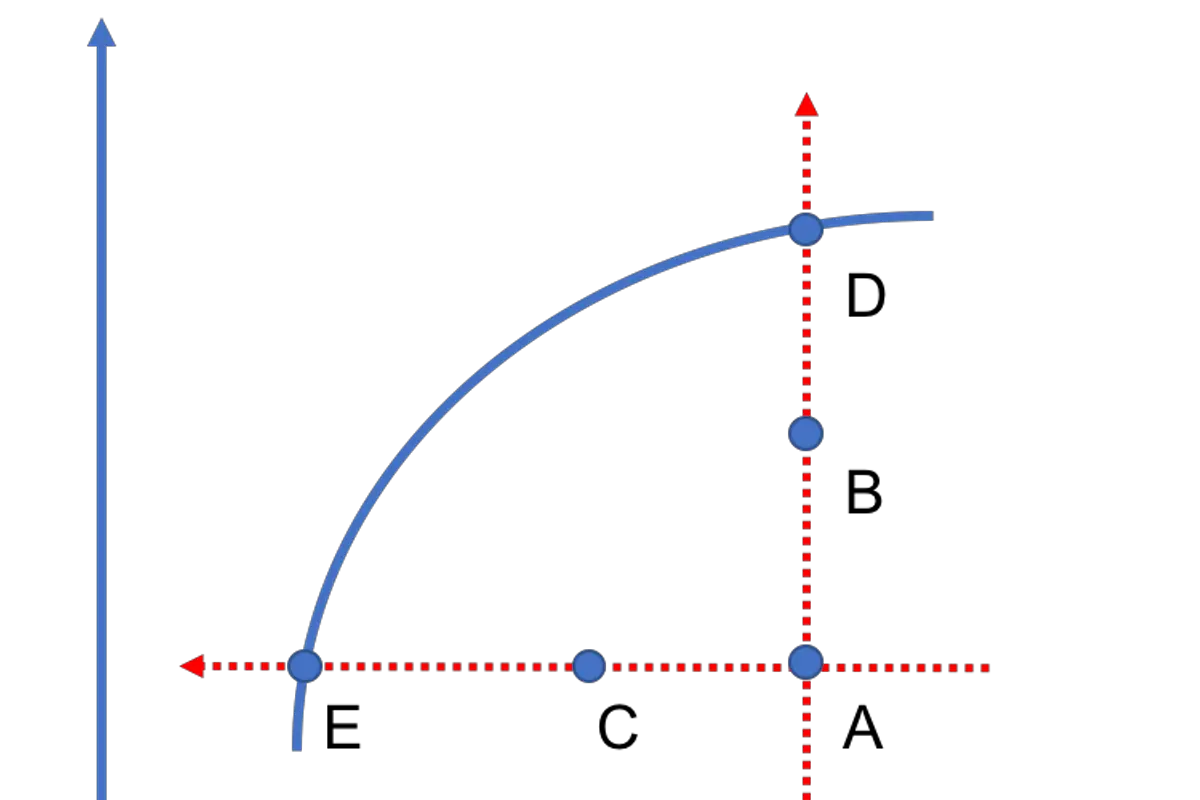

Minimum variance portfolio

In this lesson, we explain what is meant by the minimum variance portfolio (MVP), derive its formula for the two-asset case, and provide an online calculator as well. You can also check out our video tutorial to learn how to find the position of the MVP on the efficient frontier using Excel’s solver tool. And,…

-

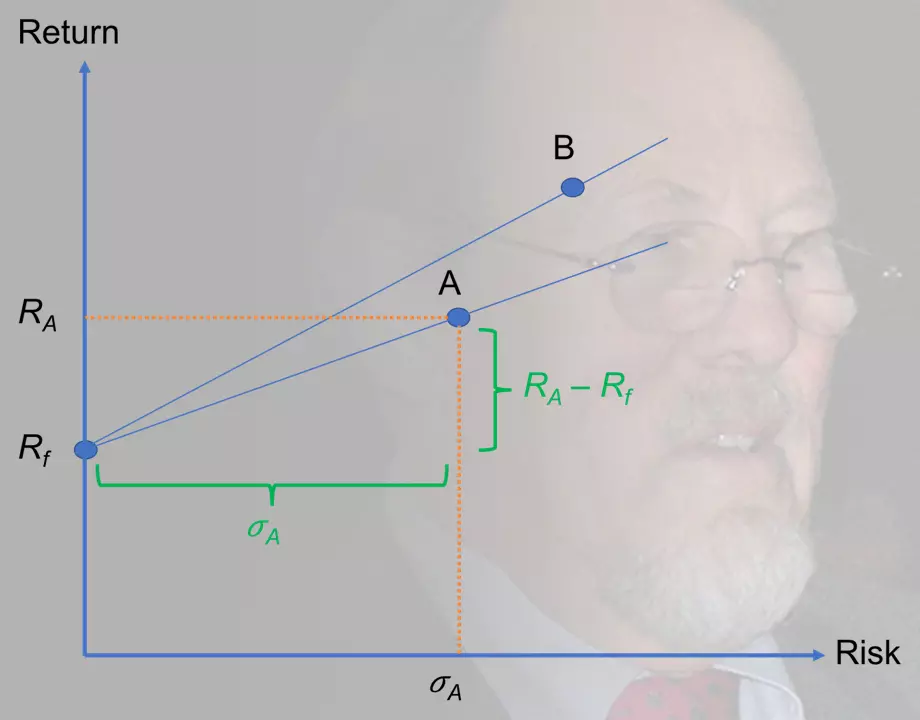

Treynor ratio formula, calculator

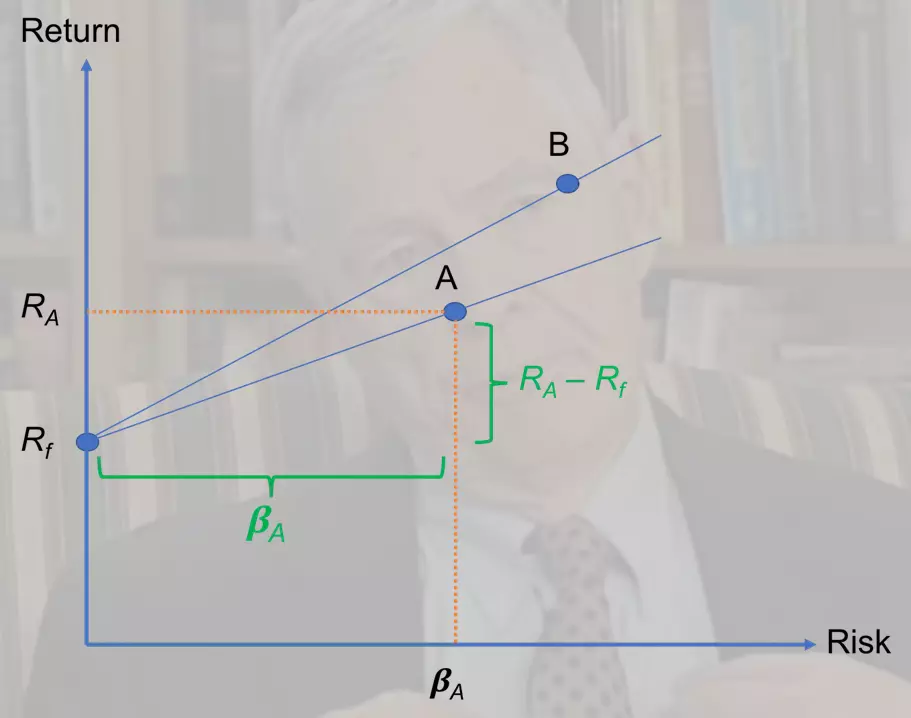

Treynor ratio is a popular risk-adjusted performance measure. It gets its name from the American economist Jack Treynor who came up with this measure in the mid-1960s (see the full reference at the end). It is a measure of how much “excess return” (i.e., return above the risk-free rate) a security (stock, bond, mutual fund, etc.)…

-

Sharpe ratio calculator, formula

Sharpe ratio is among the most widely used performance evaluation metrics in the fund management industry. It is a reward-to-risk ratio, such that it captures the (excess) return an asset (e.g., stock) generates per unit of (total) risk, which is measured by return volatility. It was developed by Nobel laureate William F. Sharpe, who is…

-

Efficient frontier calculator

In modern portfolio theory, the efficient frontier represents the collection of all efficient portfolios within a market. Efficient portfolios offer the best risk-return tradeoff and, as such, are superior to inefficient portfolios, which are suboptimal. In this lesson, we explain how investors can trace the efficient frontier using mean-variance optimization (the topic of the previous…

-

What is risk premium?

Risk premium definition The risk premium for a security (e.g., stock, bond, etc.) can be defined as the return the security generates over the risk-free rate of return. For example, if the yields on government bonds are 3%, and a stock is expected to return 8%, then this stock’s risk premium is 8% − 3% =…

-

Return volatility formula and calculator

The topic of this lesson is the return volatility of risky assets such as stocks, mutual funds, etc. We will explain how to measure it and provide a calculator as well. What is (stock) return volatility? Imagine an investor who bought shares of a stock three years ago. According to the investor’s calculations, her annual…