We begin our investments course by introducing fundamental return calculations. It’s essential to grasp the difference between gross returns and net returns from the outset. We define these two fundamental concepts below with practical examples. You might find the video tutorial at the end useful as well.

Contents

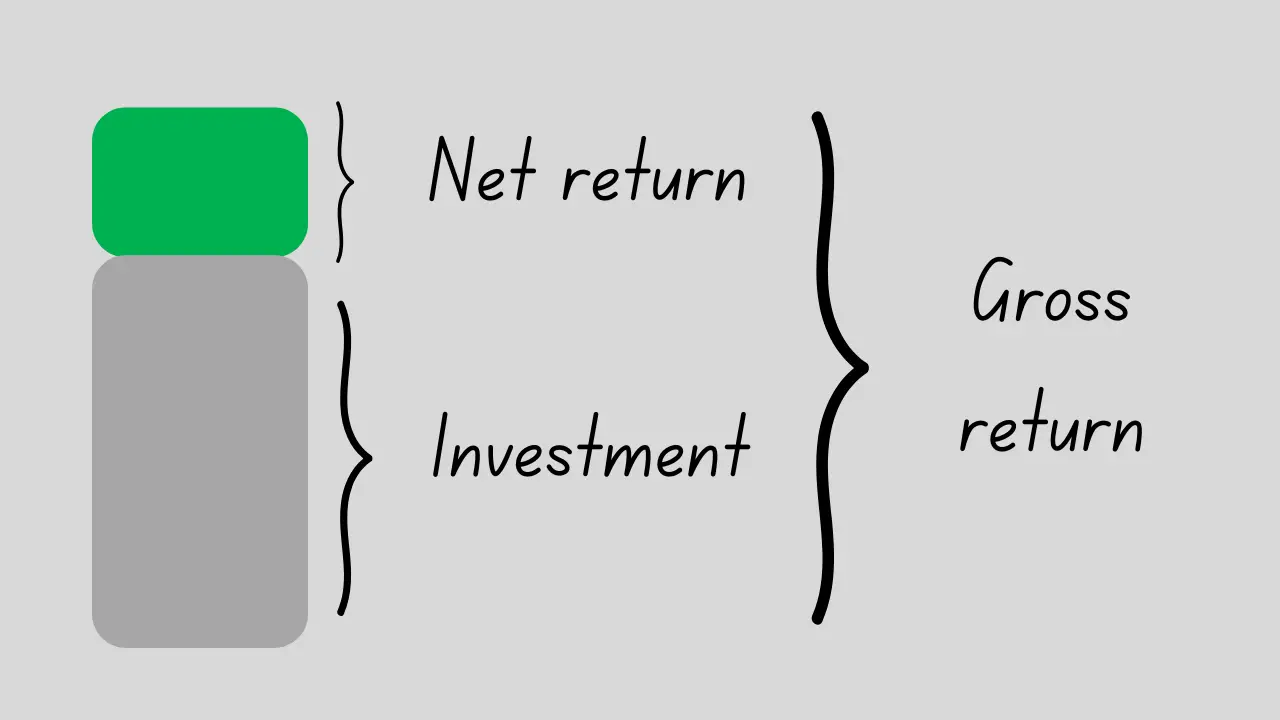

Gross return

Let’s suppose you bought shares of a stock for $10 last month, and the stock is currently trading at $11 per share. If you sold your shares now, your gross return would be:

$11 / $10 = 110%

In general, if you purchase an asset for Pt-1 at time t-1 and sell it for Pt at time t, your gross return Rt over this period would be:

As you can see, the gross return is the return you get including your original investment.

Net return

In contrast, the net return is the return you realize excluding your original investment. So, in the example given above, your net return would be:

$11 / $10 − 1 = 10%

And, the general formula for the net return rt is:

Gross return vs net return calculator

You can use the calculator below to compute the gross return and net return on an investment over a specific period. Note that the calculator assumes that there were no other cash flows (e.g., dividends, coupon payments, etc.) over this period.

Video tutorial

Summary

It is crucial for investors to understand the fundamentals of return calculations. In this lesson, we explained that the gross return captures your return from an investment including the funds you invested at the start, whereas the net return excludes your original investment.

It is important to note that the term net return is also used to refer to returns net of fees, expenses, etc. in an investment context.

What is next?

This is the first lesson in our investments course.

- Next lesson: We’ll explain how to compute the total return of a stock.

Feel free to share this post if you enjoyed reading it. And, you can contact us if you noticed any errors or have any suggestions/questions.