Tag: return calculations

-

Total return formula and calculator

In the second lesson of our investments course, we’ll be learning about a stock’s total return and its two components: capital gains and dividend yield. Total return formula Imagine that you bought a stock a few months ago for $10 per share and the current share price is $12. Based on what we learned in…

-

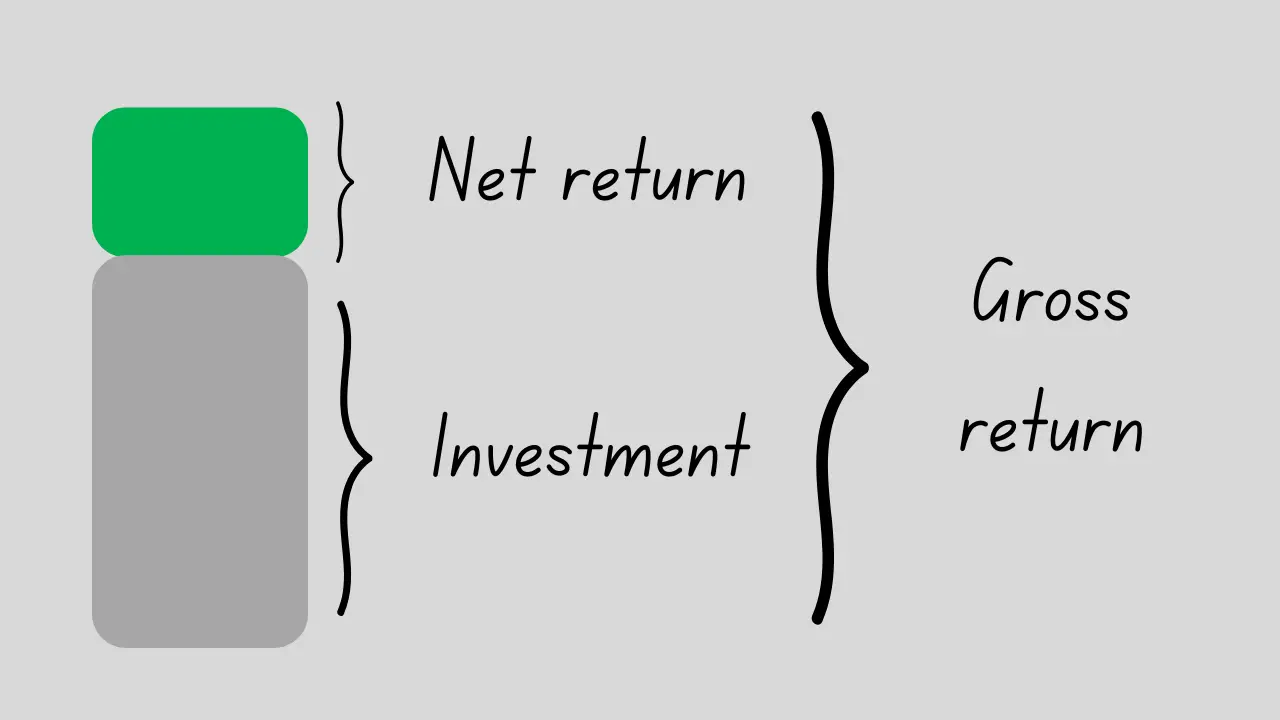

Gross return vs net return

We start our investments course by teaching you basic return calculations. One of the first things you need to understand is the distinction between gross returns and net returns. So, we begin with defining these two fundamental concepts below. You might find the video tutorial at the end useful as well. Gross return Let’s suppose…

-

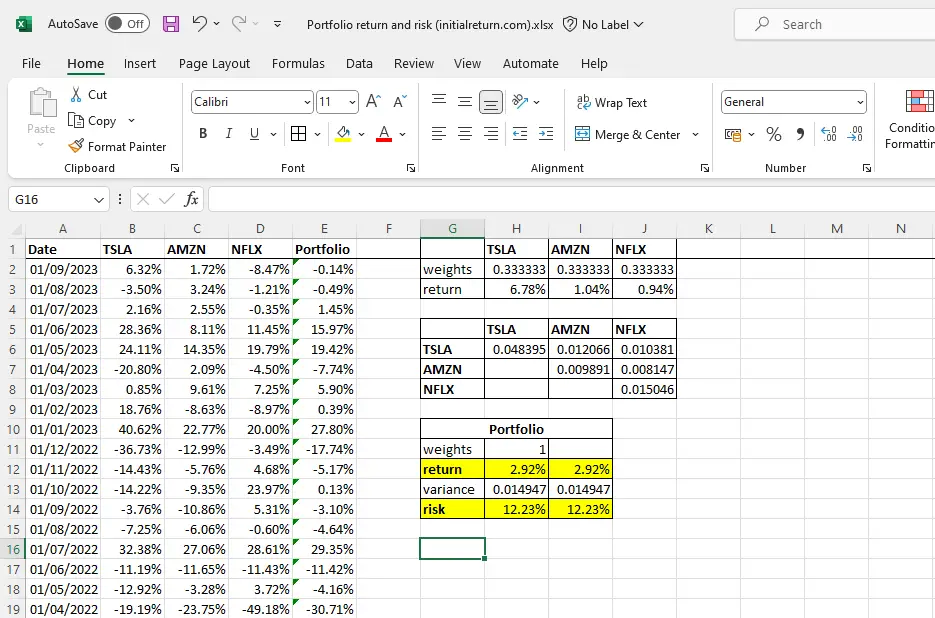

How to calculate portfolio risk and return in Excel

In this tutorial, we’ll teach you how to calculate portfolio risk and return in Excel. We’ll focus on an example where we construct a portfolio of the following three stocks: Tesla (TSLA), Amazon (AMZN), and Netflix (NFLX). If you’re unfamiliar with the formulas for portfolio return and portfolio risk, we’d recommend you check the following…

-

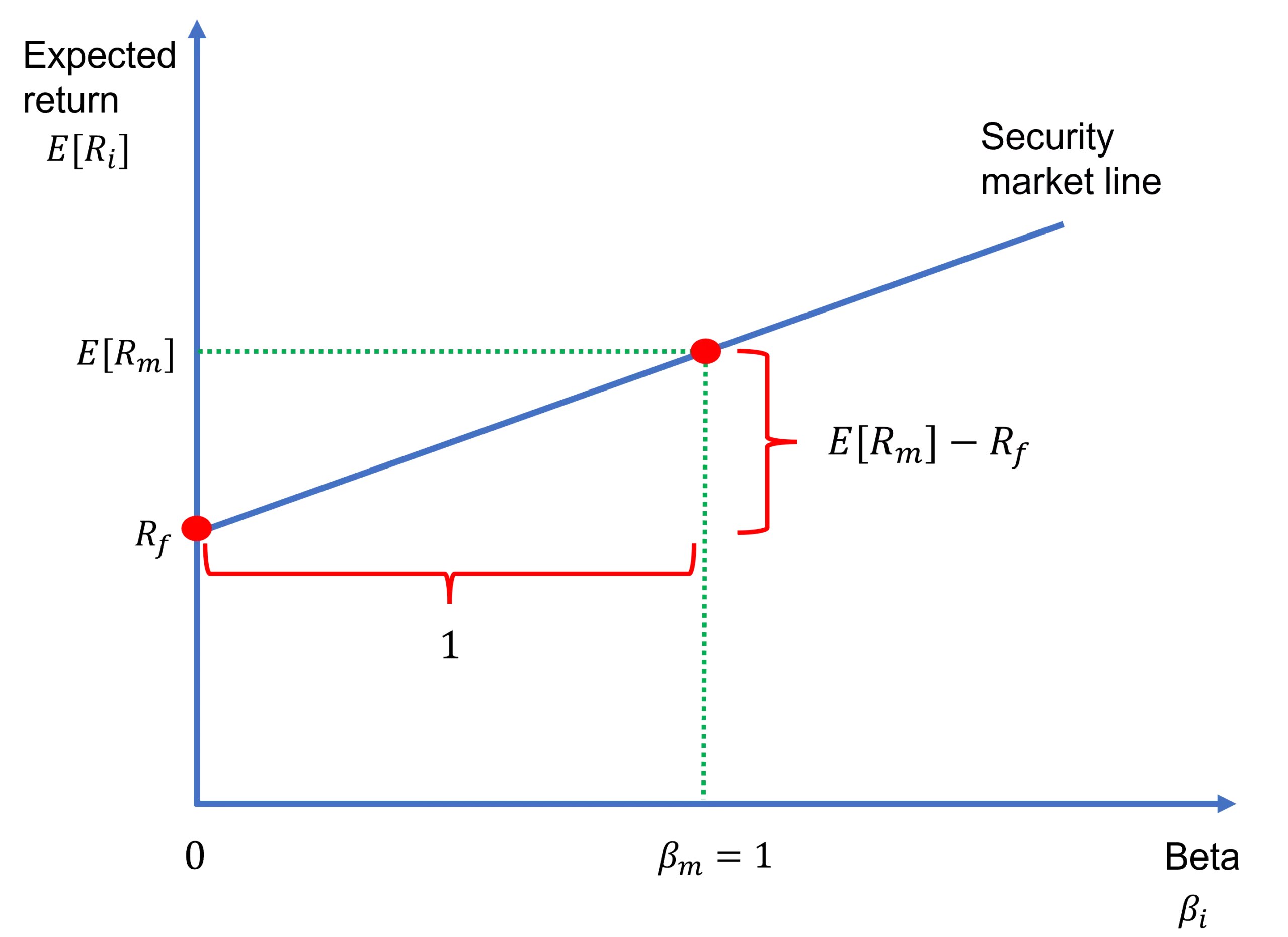

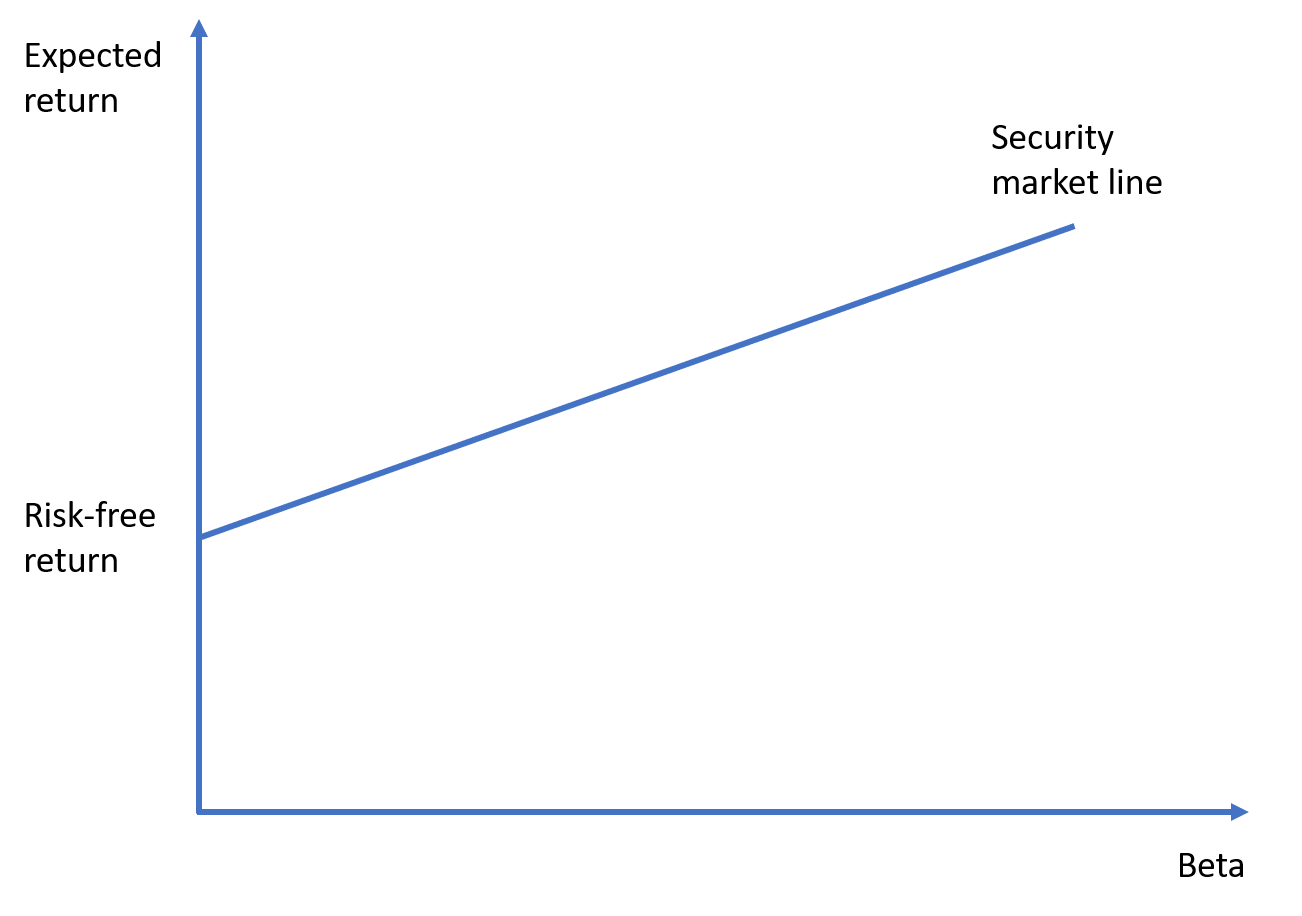

Security market line

The security market line (SML) depicts the linear relationship between expected return and systematic risk, which is measured by beta, according to the capital asset pricing model (CAPM). Specifically, the equation of the security market line is nothing but the CAPM formula: where E[Ri] is the expected return on asset i, E[Rm] is the expected…

-

Capital asset pricing model (CAPM)

The capital asset pricing model (or CAPM) is among the most widely-used asset pricing models by stock analysts and portfolio managers. Its popularity arises from its simplicity and elegance. Analysts and investors can use it to forecast returns or to estimate the cost of equity. In this lesson, we explain this model and its assumptions.…

-

What is risk premium?

Risk premium definition The risk premium for a security (e.g., stock, bond, etc.) can be defined as the return the security generates over the risk-free rate of return. For example, if the yields on government bonds are 3%, and a stock is expected to return 8%, then this stock’s risk premium is 8% − 3% =…

-

What is the risk-free rate?

The risk-free rate is the rate of return earned on a risk-free asset. While returns on risky assets such as stocks are uncertain, the key distinction of the risk-free rate of return is that we know its exact value at the time of investment. For example, we may expect a stock to yield 8% over…

-

Return volatility formula and calculator

The topic of this lesson is the return volatility of risky assets such as stocks, mutual funds, etc. We will explain how to measure it and provide a calculator as well. What is (stock) return volatility? Imagine an investor who bought shares of a stock three years ago. According to the investor’s calculations, her annual…

-

Geometric average return calculator and formula

In this post, we explain the geometric average return formula using numerical examples and discuss how it differs from the arithmetic average return. We provide a practical geometric average return calculator as well. Geometric average return formula The geometric average return formula can be written as follows: While the formula looks complicated at first sight,…

-

Investments quiz – Test your knowledge!

in investmentsThis investments quiz aims to test your knowledge of the material covered in our free investments course. The quiz is a multiple-choice test. It consists of three sections: The solutions are provided at the bottom of this page. Section A: Return calculations 1. You buy a single share of a stock for $10. After three…