Category: asset pricing

-

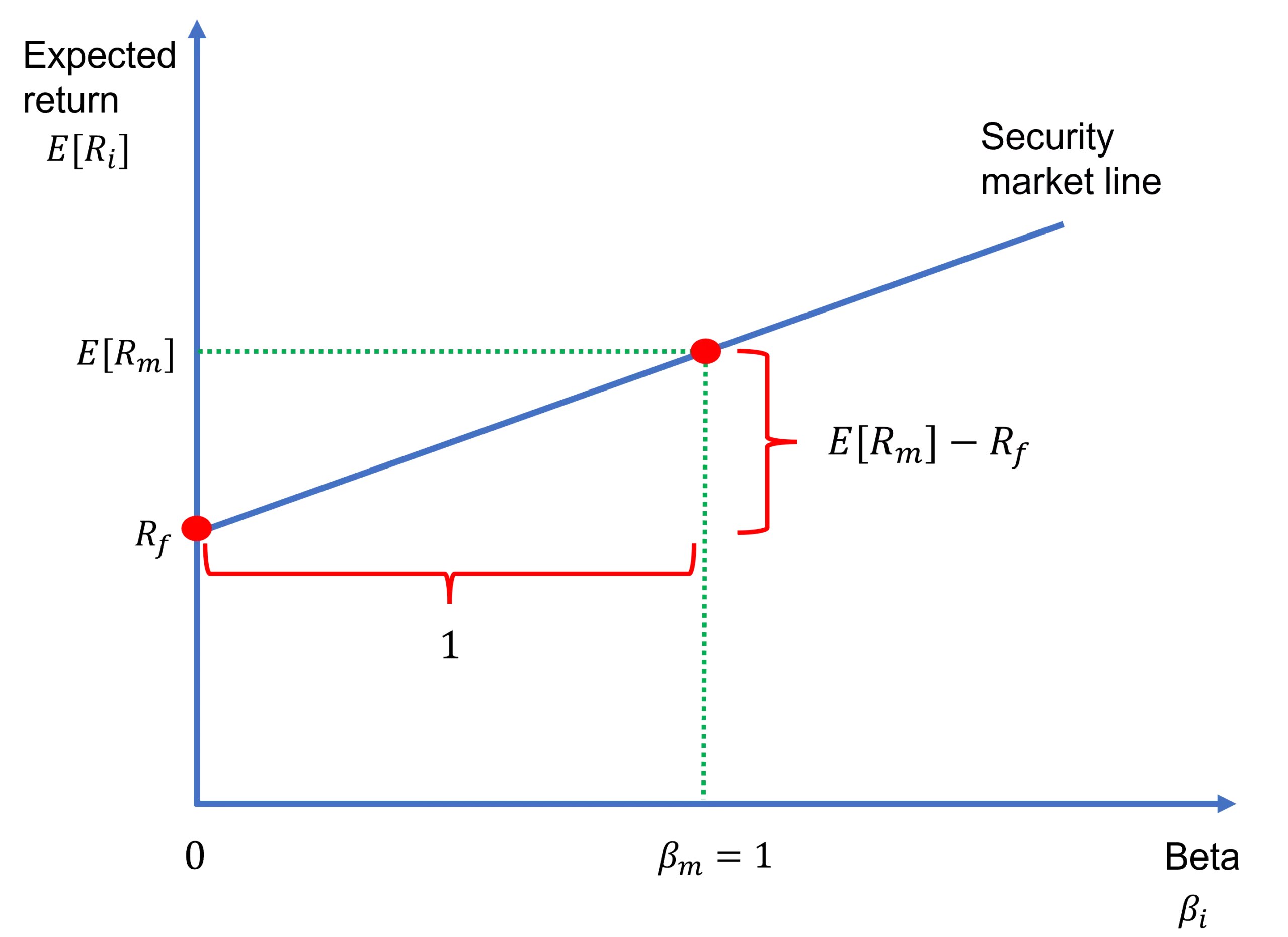

Security market line

The security market line (SML) depicts the linear relationship between expected return and systematic risk, which is measured by beta, according to the capital asset pricing model (CAPM). Specifically, the equation of the security market line is nothing but the CAPM formula: where E[Ri] is the expected return on asset i, E[Rm] is the expected…

-

Market portfolio

We have so far learned how to calculate the risk and return of portfolios and how to trace an efficient frontier through mean-variance optimization. It is now time to introduce a special portfolio that will play a significant role when we discuss the CAPM: The market portfolio. What is the market portfolio? The market portfolio is the…

-

Capital asset pricing model (CAPM)

The capital asset pricing model (or CAPM) is among the most widely-used asset pricing models by stock analysts and portfolio managers. Its popularity arises from its simplicity and elegance. Analysts and investors can use it to forecast returns or to estimate the cost of equity. In this lesson, we explain this model and its assumptions.…

-

Fair game meaning

In daily language, “fair game” can be used to suggest that something or someone can be an object of criticism (perhaps because of their behavior or nature). But, what about the meaning of fair game in an economic or financial context? In such a context, a fair game can be defined as a game in…

-

Risk aversion coefficient – meaning and formula

When we discussed investors’ risk preferences, we distinguished between risk-averse, risk-neutral, and risk-seeking behavior. We also explained that risk-averse investors expect compensation for bearing risk, which is called a risk premium. But, how do measure a person’s level of risk aversion? The answer is the risk aversion coefficient. It quantifies the degree to which an…

-

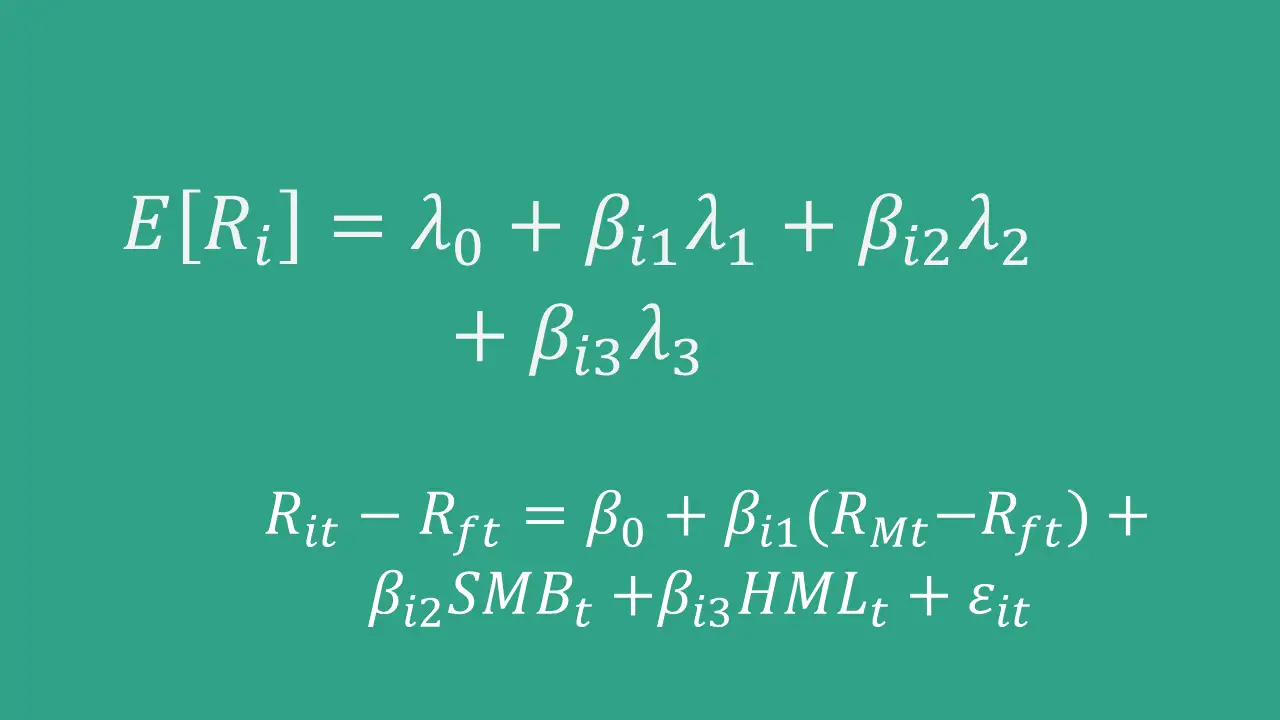

Arbitrage pricing theory (APT)

Arbitrage pricing theory (APT) is an asset pricing model developed by the American economist Stephen Ross in the mid-1970s. While the capital asset pricing model (CAPM) posits a single systematic risk factor, which is the market risk, arbitrage pricing theory accommodates multiple risk factors. As such, APT has been the driving force behind the growth of multi-factor…