This lesson delves into the distinction between nominal returns and real returns, illustrating how inflation affects return calculations. Additionally, you’ll learn the method for computing the real rate of return by utilizing both the nominal rate of return and the inflation rate.

Contents

How does inflation affect investment returns?

Inflation can be loosely defined as an increase in the prices of goods and services. The problem with a high rate of inflation is that it leads to a significant loss in purchasing power. To understand that consider the following example.

Suppose that an asset yields a return of 50% over a year. So, if you invest $10,000 today, your investment grows to $15,000 by the end of the year. Sounds not too bad, right? But, imagine that the inflation rate over the course of the year was 60% (this is highly unlikely in most economies, but just imagine). Then, the asset no longer looks so appealing as the return it offers fails to keep up with the rate of inflation!

Let’s further elaborate on this example. Suppose that a luxury hot tub costs $5,000 today. This means that with the $10,000 you have, you could afford 2 hot tubs at the moment. And, if your investment grew to $15,000 at the end of the year, you would be able to buy 3 hot tubs if its price didn’t change. But, if it rose in line with the inflation, which we assumed to be 60%, hot tubs would cost $8,000 in a year’s time. This means that while you can buy 2 hot tubs now, you wouldn’t be able to do that next year. This example is summarized in the table below.

| Today | 1 year later | |

|---|---|---|

| The value of your investment | $10,000 | $15,000 |

| Hot tub prices | $5,000 | $8,000 |

| The number of hot tubs you can afford | 2 | 1 |

In summary, one needs to take into account the rate of inflation (especially when it’s high), when interpreting investment returns.

Real return vs nominal return and their relation to inflation

In general, we refer to the rate of return that is unadjusted for the rate of inflation as the nominal return and the one that is adjusted as the real return. So, in our example, the nominal return is 50%. But, how do we calculate the real return, given that the inflation rate is 60%?

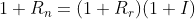

The relation between the nominal return Rn, real return Rr, and the inflation rate I is governed by the following equation:

If we plug Rn = 50% and I = 60%, we get:

1 + 50% = (1 + Rr)(1 + 60%)

1.5 = (1 + Rr)(1.6)

Rr = 1.5 / 1.6 − 1 = −6.25%

This means that while the asset offers a quite high nominal return (50%), we would actually lose money in real terms (−6.25%) with this investment because the inflation rate (60%) is too high at the moment…

However, if the inflation rate went down to, say, 2%, the investment would now look very attractive:

1 + 50% = (1 + Rr)(1 + 2%)

1.5 = (1 + Rr)(1.02)

Rr = 1.5 / 1.02 − 1 = 47%

Note that so long as the inflation rate is positive, the real return is always smaller than the nominal return. Moreover, when the rate of inflation is low, the real return is approximately the difference between the nominal return and the inflation rate (the Fisher equation):

Rr ≈ Rn − I

So, when the inflation rate is 2%, we have:

Rr ≈ 50% − 2%

Rr ≈ 48%

This is indeed close to the exact figure of 47%, which we calculated above.

Summary

In the presence of a high inflation rate, it is important for investors to focus on real returns rather than normal returns as the former is inflation-adjusted.

Further reading:

Crowder and Hoffman (1996) ‘The Long-Run Relationship between Nominal Interest Rates and Inflation: The Fisher Equation Revisited‘, Journal of Money, Credit and Banking, Vol. 28 (1), pp. 102-118.

What is next?

This lesson is part of our free course on investments.

- Next lesson: We will explain how to calculate holding period returns when assets are held over multiple periods.

- Previous lesson: We showed how to compute the total return of a stock based on its capital gains and dividend yield.

Please share this post with your friends and connections if you enjoyed reading it. Also, please contact us if you noticed any errors or have any suggestions/questions.