Sequence of returns risk is the risk that your investments will fall sharply in the first 5-10 years of retirement and larger returns will not come soon enough to allow them to recover.

This risk is specific to the descent stage of your financial journey, when you are drawing an income from your investments in retirement, because you will be forced to make withdrawals when the market is down. If this happens, you could run out of money—a retiree’s worst nightmare!

There is another type of sequence of returns risk that isn’t usually discussed, however. So before you think, “I’m not retired yet. This doesn’t matter to me,” consider this:

Sequence of returns risk also exists if you are on the ascent stage of the Pathway to Financial Independence (FI), saving and investing to reach FI and the ability to live on your investments. In this case, it’s the opposite risk that the market will fall sharply in the last 5-10 years before your target retirement date and you will not have saved enough to retire at that point. Good returns in the early years are not usually enough to offset bad returns in the late years of savings because they cause you to pay higher prices for future investments and therefore buy fewer shares of companies along the way.

- A retiree could run out of money if they experience a bad sequence of returns at the beginning of retirement.

- A saver could miss their expected retirement date in the event of a bad sequence of returns at the end of their career.

- A good financial plan protects against both types of sequence of returns risk.

First, let’s discuss some of the periods in recent history where sequence of returns risk was realized for retirees and savers. Then we’ll go through an example to illustrate how critical sequence of returns is to the outcome of both stages.

Contents

Historical examples of sequence of returns risk

“Life is like a box of chocolates. You never know what you’re going to get.”

– Forrest Gump

We cannot know what the future holds for market returns in our last 10 years of saving or the first 10 years of retirement. However, studying a few historical examples can help us understand the range of situations that might occur and how they worked out.

For simplicity, let’s assume both a 30-year retirement and a 30-year savings period. Let’s also assume that the portfolio is invested in large US companies, represented by the S&P 500 index.

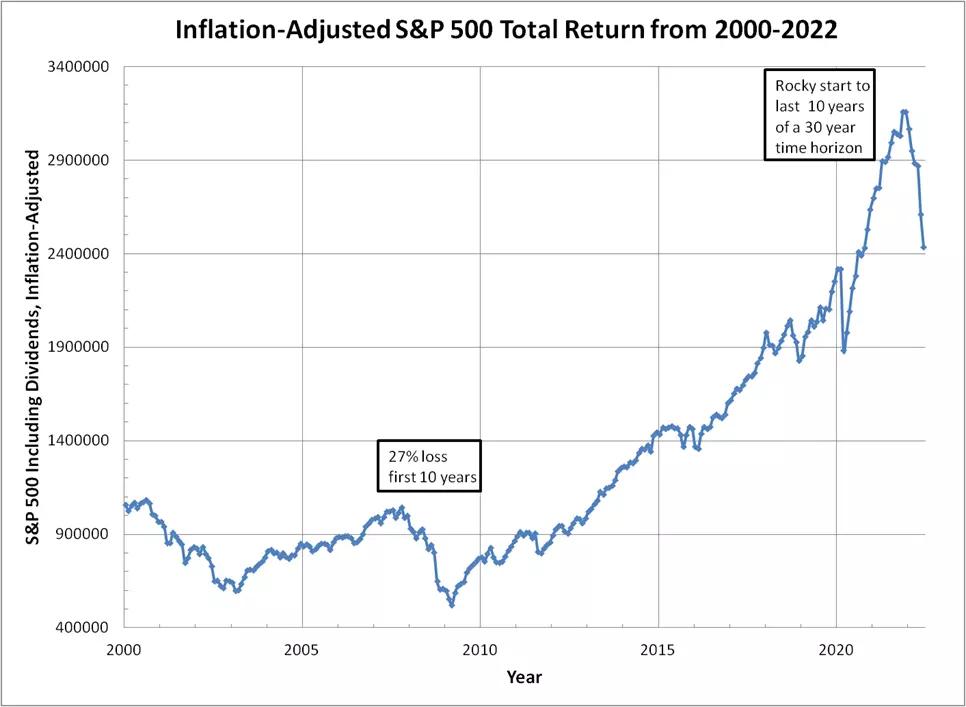

The 2000-2030 period

A bad sequence of returns occurred for people who retired in 2000 at the peak of the dot-com bubble when the stock market dropped by 27% over the next 10 years after accounting for inflation and reinvesting dividends. Something similar happened in 1973 during a period of high inflation and slow economic growth. Stocks dropped 19% in the first decade.

We don’t have all the data yet on how the 2000-2030 group will perform. So far, 2020-2022 has had big ups and downs. Savers can consider the down periods an opportunity to buy companies on sale and hope that the market will continue its 2010-2020 trend as they move toward retirement. See Figure 1 for details.

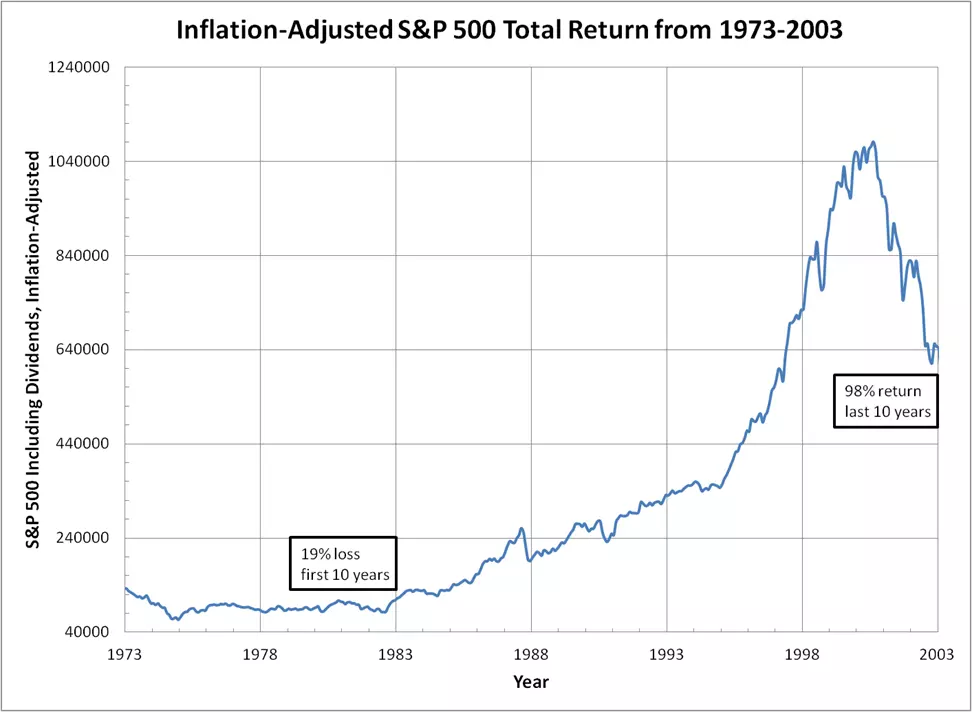

Examples from the 1950-2010 period

Figure 2 shows that 1973-2003 savers had a good sequence of returns in their last decade. Stocks rose 98%, even with a 40% drop from 2000-2003!

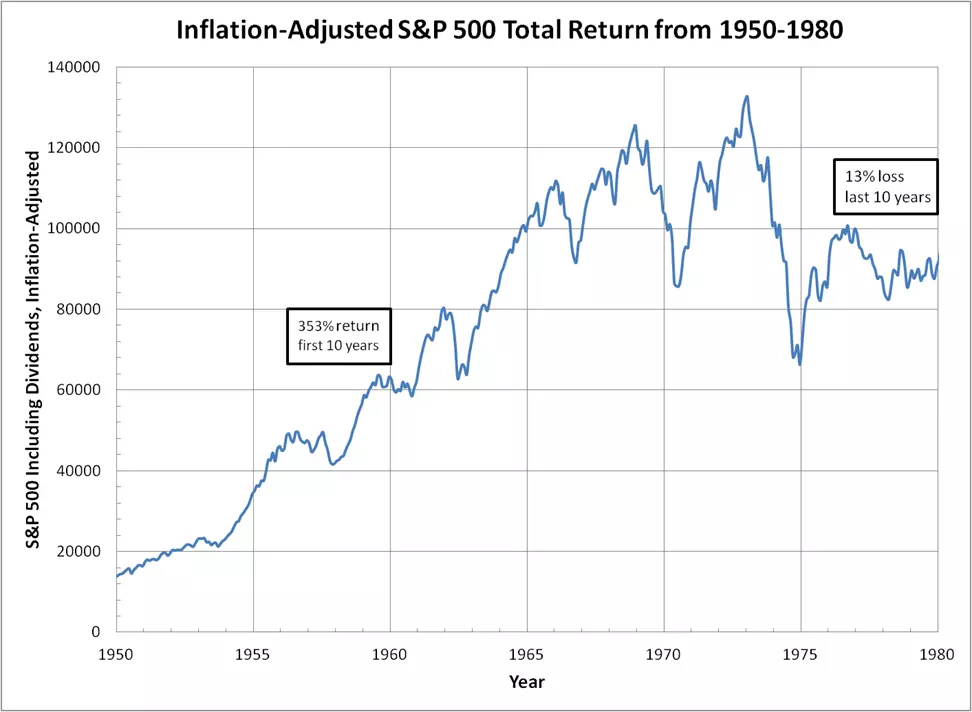

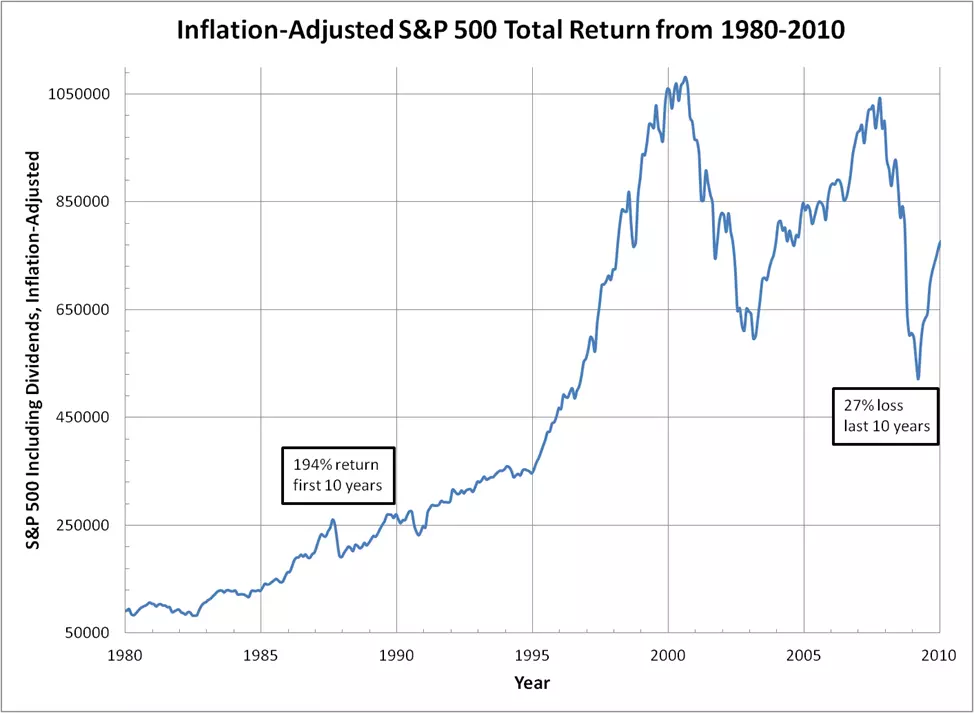

Retirees in 1950 and 1980 had a good sequence of returns. The stock market rose by 353% and 194% respectively during the first decades of those periods! In contrast, savers from 1950-1980 and 1980-2010 had a bad sequence of returns in their last decade as the market lost 13% and 27% respectively. See Figure 3 and Figure 4 for details.

There are several other examples like these throughout history.

Retiree and saver portfolio results

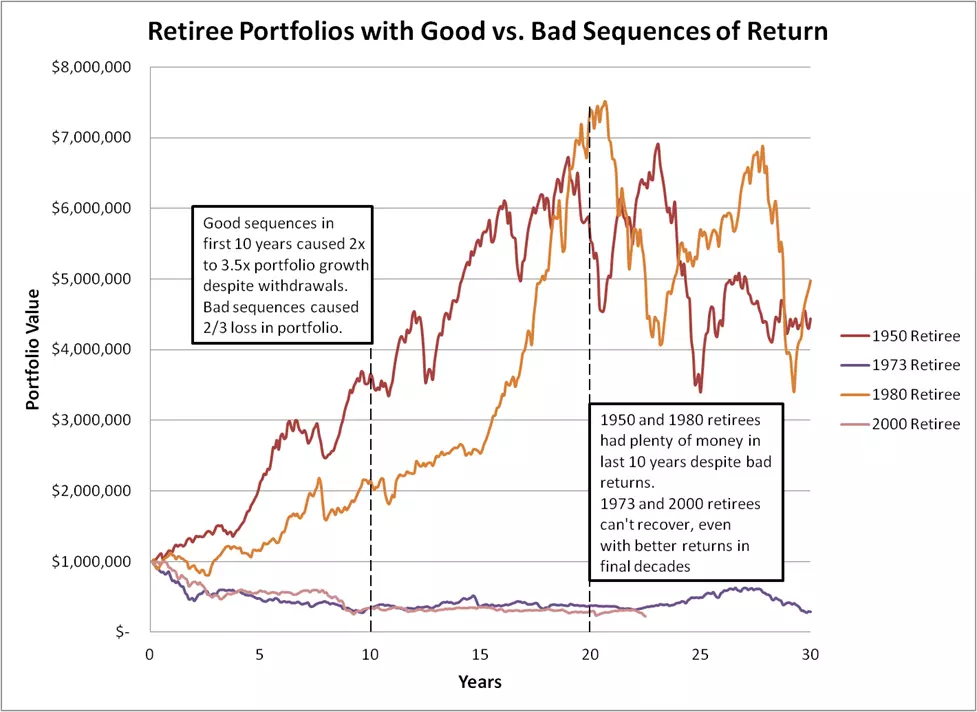

To illustrate the financial impact of sequence of returns risk, let’s assume that the retirees began with a $1 million portfolio and withdrew money at a 4% rate of $40,000 per year, adjusting upward for inflation each year.

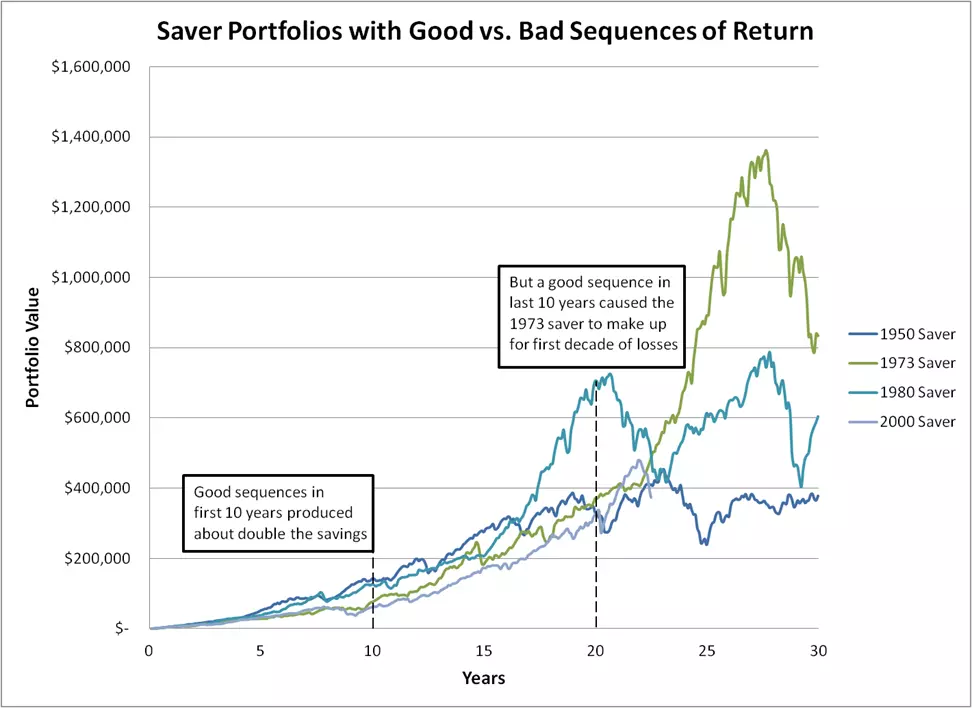

Our savers put away $6,000 per year and increased the amount they saved by 2% above inflation each year.

How did our retirees fare?

According to Figure 5, the 1950 and 1980 retirees did well. This was expected based on the good sequences of return in the first 10 years. As you can see, their portfolio values remained strong even though markets declined in the last 10 years of retirement. These retirees were not at risk of running out of money.

The 1973 and 2000 retirees had a bad sequence of returns that caused them to lose 2/3 of their money in the first 10 years. Even though the stock market did well after that, it was too little too late. We don’t know what will happen in the last 7.5 years for the 2000 retiree, but there is no realistic expectation that the portfolio can recover to its original value and a significant possibility that it will run out of money instead.

How about the savers?

The saver’s situation is not decided in the first 10 years, as you can see from Figure 6. There is a clear difference between the portfolios with good returns and bad returns in the first 10 years, but continued contributions and investment returns cause the 1973 and 2000 savers to catch up to the 1950 saver by year 20 and the 1980 saver around year 22.

A bad sequence of returns in the last decade for the 1950 and 1980 savers caused them to fall far behind the good sequence that the 1973 saver experienced. It will be the last 5-10 years for the 2000 saver that decides the “success” of the portfolio and whether it beats the 1950 and 1980 savers as well.

How to mitigate sequence of returns risk?

I’ve shown that sequence of returns risk happens in the first decade of retirement and the last decade of saving for retirement.

We have no control over what market returns we get. So what can we do?

We can control how much we save each month. We can keep ourselves from jumping in and out of the market and missing the big returns that often come when we least expect them. And we can diversify our portfolio to reduce sequence of returns risk once we have reached financial independence.

What action will you take to reduce sequence of returns risk and set yourself up for financial success?

Video summary

Author Bio

Blake is a former engineer, who reached financial independence (FI) in his 30s, then moved his family from the city to a small Colorado mountain town to raise his young daughter and spend more time outdoors.

He is passionate about writing, teaching, and coaching others about personal finance and helping them to achieve FI and live their best lives.

Blake now writes at PathwayToFI.com, where you can find model portfolios for each stage on the path to FI, tips, tricks, and strategies for reaching FI quickly without compromising the things you value most in life, and sign up for a free weekly newsletter with timely insights and articles designed to help you succeed in your finances and in life.

What is next?

If you have enjoyed this article on sequence of returns risk, we recommend you browse our free course on investments and free tutorial on analyzing stock returns.

We welcome insights from finance and investment specialists. If you’d be interested in writing for us, you can contact us here.