The psychology of trading encompasses the emotional states and moods that traders go through during their trading activities. Emotional trading can have an adverse impact on a trader’s performance, leading to mental issues as well as financial loss. Therefore, all traders should have at least a basic understanding of how emotions influence trading activity.

We’ve structured this lesson into three parts to help traders gain an understanding of trading psychology. We begin by discussing the emotions that have the most significant impact on trading activity: greed, fear, pride, and regret. Then, we explain how emotional trading emerges under the influence of different emotional states. Finally, we offer tips that can support traders in managing their emotions during trading.

Contents

Common emotions in trading

Greed and fear

Greed and fear are among the key emotions that come to the surface during trading. They can have a significant impact on risk-taking by distorting an emotional trader’s assessment of the true probabilities of events happening.

Let’s suppose a stock would yield stellar returns if events X, Y, and Z all happened at the same time. Of course, the probability of that happening might be very small. But, a greedy trader might end up exaggerating that probability and, thus, heavily invest in that stock instead of other solid stocks that yield consistently good (but not stellar) returns.

The reverse is true as well: A fearful trader may shun good stocks if he or she exaggerates the probability of a certain event that would cause those stocks to nosedive.

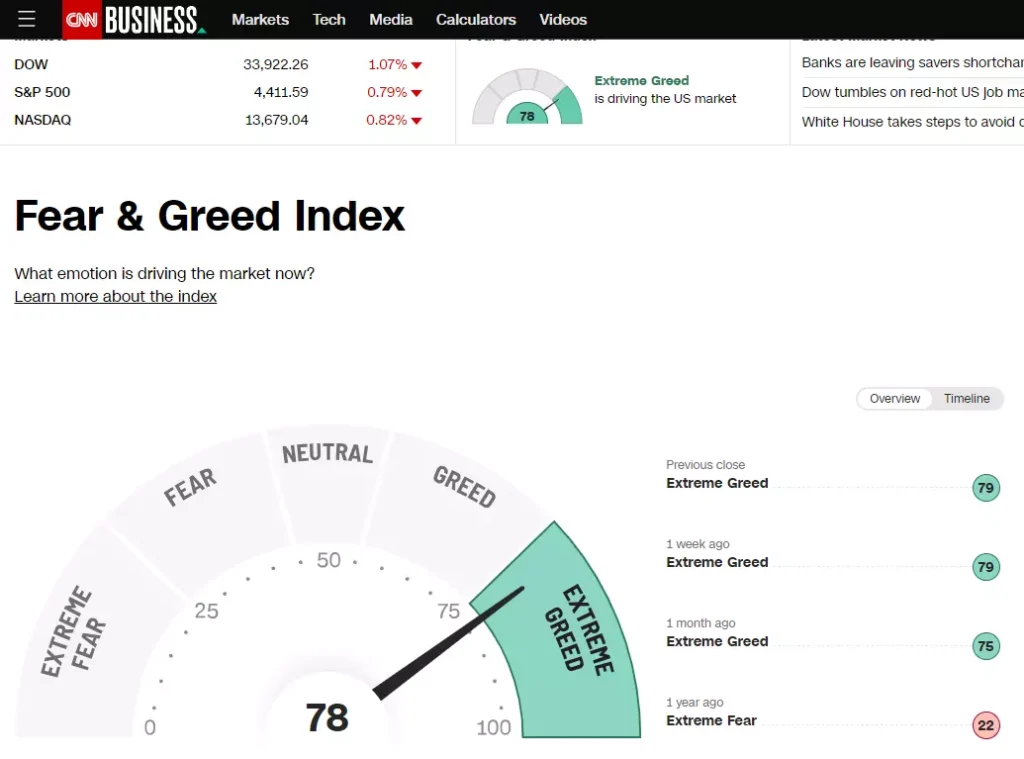

Overall, greed and fear can harm traders by causing them to exaggerate the probabilities of rare events. In fact, CNN has a popular “Fear & Greed Index” (see Figure 1), which captures these two emotions at the market level.

It’s important for both traders and investors to be aware of the dangers of these emotions driving their trading behavior. Professional traders and investors recognize this fact (see Warren Buffett’s quote below).

“Be fearful when others are greedy, and greedy when others are fearful.”

— Warren Buffett, CEO of Berkshire Hathaway

Pride and regret

Like greed and fear, pride and regret can be behind various types of trading behavior.

We’d feel proud if our trading strategy worked out well. The feeling of pride would make us share our success with others and even “show off” in some cases. The problem here is that such reactions can cause us to trade in a suboptimal manner. For example, we might close a profitable position too early in order to go off to share our success.

The emotion of regret would surface in the opposite scenario when one or more trades start to generate losses. Regret is a powerful emotion and has more valence than pride. So, in many scenarios, we’d do all we can to avoid the feeling of regret. This is known as regret avoidance, and it can lead to poor trading choices as we explain under the Emotional Trading section below.

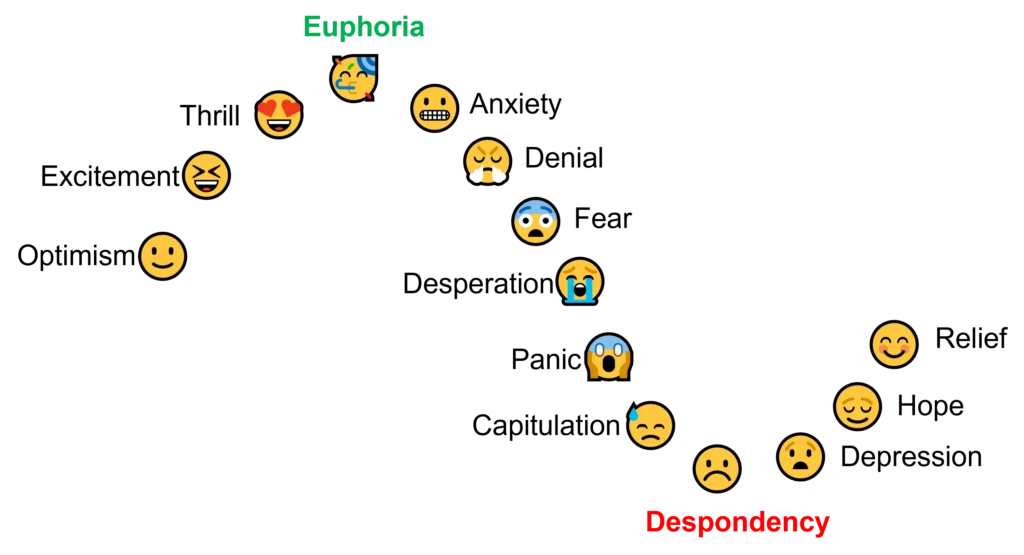

14 emotional states of a trader

Trading can be a nerve-breaking experience for beginners. Traders would go through a full spectrum of emotions ranging from euphoria to despondency over the course of a market cycle. In fact, the emotional trader can experience up to 14 different emotions during a single market cycle as illustrated in Figure 2.

And, here’s the narrative for the trader’s psychology during the market cycle:

At the onset of a bull market, emotional traders become engulfed in a wave of unwavering optimism. This would induce them to invest in the stock market. With each upward tick, excitement mounts, propelling them to expand their stock portfolios further, ultimately driving prices even higher. They experience the thrill of witnessing the market index surge and their portfolio values flourish day by day. As the market scales unprecedented heights, they find themselves swept away by a state of euphoria.

However, as the market’s upward momentum abruptly halts, a sense of unease permeates the air. Has the party reached its climax? Is this the pinnacle? Anxiety creeps in, prompting these questions. Denial sets in as a defense mechanism: Maybe the forecasts aren’t as rosy, but surely nothing of substance has shifted! Those cautioning about a downturn are merely overly pessimistic economists! Yet, subsequent weeks bring a deluge of unfavorable news. Fear encircles traders as they witness their hard-earned profits dwindle. Desperation lingers as they anxiously await signs of a revival. Unfortunately, most of their prior gains have dissipated, leaving them disheartened.

As markets continue their downward spiral, panic ensues, marking the emotionally grueling phase. Traders find themselves engulfed in a sense of helplessness, a profound loss of control. Capitulation becomes inevitable, as they reluctantly accept defeat, willing to sell their stocks at any price to stem further losses. Under a cloud of despondency, a fraction of traders choose to exit the market, bidding farewell indefinitely.

Having weathered the storm, traders find themselves in a state of depression, plagued by regret and the agonizing sting of losses. Yet, as time passes, flickers of optimism gradually illuminate the horizon. Traders cautiously entertain renewed hope. A sense of relief is felt as market conditions begin to improve, signaling the advent of a new cycle, brimming with possibilities.

Emotional trading

Selling winners, holding on to losers

A commonly observed trading behavior that can hurt performance is the disposition effect. It can be defined as investors’ tendency to hold on to “losing” stocks while selling “winning” stocks more easily (losing and winning are relative to the purchase price). In a seminal paper, Shefrin and Statman (1985) (full reference here) argue that pride and regret can be instrumental in generating the disposition effect.

In particular, selling a stock at a gain gives a trader a source of pride. After all, the trader can boast to his colleagues about his profits and how he made such a wise investment decision. This would give a mental push to that trader to sell winning positions early instead of holding on to them.

In contrast, selling a stock at a loss brings pain to the trader. The trader would most likely regret buying the stock in the first place and would find it difficult to report his losses to family members and friends. Consequently, he’d keep holding on to the stock with the hope that it would gain in value eventually, which may never happen.

“Cut your losses and let your winners run.”

— Investment adage

Revenge trading

Revenge trading involves initiating trades that are emotionally driven and not aligned with the trader’s strategy, following losses on previous trades. The aim is a quick recovery of earlier losses. However, this often leads to further losses when the positions taken during revenge trading aren’t carefully thought out.

Revenge trading gets particularly dangerous if the trader gets into a mindset of gambling to recover earlier losses.

For these reasons, revenge trading is a prime example of trading on emotions. The hope is to avoid the feeling of regret that would set in if the losses were to be realized. But, such impulsive reactions make things only worse as the trader loses focus and doesn’t follow his or her trading strategy. The following quote sums this up nicely.

“The market doesn’t owe you anything. Avoid revenge trading and focus on maintaining a consistent and disciplined approach.”

— Linda Bradford Raschke, American financier

Analysis paralysis

A trader suffers from analysis paralysis if he or she becomes unable to execute certain trades due to overthinking “what if”s. Of course, traders should conduct proper research when developing their trading strategies. But, the keyword here is “overthinking”. This could cause traders to pass up good trading opportunities.

The emotion of fear and other related ones are the culprits behind analysis paralysis. Trading is not the right profession for an individual who can’t handle risk. Risk is inherent to trading. Traders should have a risk management system in place and should think carefully before executing a trade. However, once all the necessary steps are taken, they shouldn’t remain inert due to analysis paralysis. They should learn to control their fear in order not to miss good opportunities.

“Analysis paralysis leads to missed opportunities. Sometimes, the best trade is the one you don’t overthink.”

— Paul Tudor Jones, CEO of Tudor Investment Corporation

How to avoid emotional trading

In the final part of our lesson on the psychology of trading, we give a number of tips that can help traders manage their emotions to improve their performance.

Understand your risk appetite

Many of us dislike risk and want to be rewarded for accepting risk. However, the degree of risk aversion varies among traders. Some traders might be willing to bear more risk than others.

It is important for you as a trader to bear no more risk than you are comfortable with. This would largely preclude you from being at the mercy of your own emotions during volatile markets.

The bottom line is, traders should be clear about their risk appetite. In fact, investment companies commonly measure their clients’ risk tolerance before recommending products to them. Here are some example questionnaires, if you’d like to try them out:

https://www.standardlife.co.uk/investments/tools/investment-risk

https://pfp.missouri.edu/research/investment-risk-tolerance-assessment/

https://www.hsbc.com.mt/wealth-management/risk-tolerance-questionnaire/

Once a trader understands his risk appetite, he can build a suitable risk management system to support his trading strategy.

Demo trading account

Another tip to avoid emotional trading is to practice trading with a demo account before risking real money. This would help you gain experience in a safe setting without suffering any financial losses. It is particularly important for beginners to understand the mechanics of trading (placing a trade order, choosing the right type of order, etc.) and the level of risk involved in different types of securities (e.g., large caps vs. small caps, stocks vs. bonds, etc).

There are many digital platforms out there that offer trading simulators and demo trading accounts. We’ve listed a few below for your convenience.

https://www.wallstreetsurvivor.com/

https://tradenation.com/trading-simulator

https://platform.thinkorswim.com/platform/index.html#!/pmregister

Trading plan

It is unlikely for a trader to find success by executing trades randomly. One of the key traits of successful traders is their ability to come up with sensible trading plans, review them periodically, and make revisions if needed. This simplifies the trading process and helps create a routine for the trader.

It also reduces the risk that emotions would overtake rational thinking during volatile periods as the trader puts an effort to stick to the plan. The trading plan serves as a self-disciplinary mechanism.

A good trading plan, among other things, should take into account the trader’s risk tolerance. This would help the trader decide how to split funds across different asset classes and/or securities. The plan also should include clear trading strategies that form the basis of all trading activity. It should indicate when to take profits and when to stop losses.

Trading journal

An important learning mechanism for every trader is to evaluate past performance as objectively as possible. Rather than boasting about past profits, some of which might be due to pure luck, check if a certain strategy consistently led to success. Also, instead of simply regretting decisions that yielded losses, try to spot if a certain type of reasoning commonly led you to buy losing stocks. This approach would help you detach from the emotions of pride and regret and support you in delineating the trading actions and strategies that pay off.

In this context, keeping a trading journal can be really helpful. If you can’t do this daily, consider keeping at least weekly summaries. Think of the trading journal as an instrument for reflection on your trading activity. Periodically review older entries to refresh your memory about your past wins and losses.

Summary

In this lesson, we have offered a detailed discussion of the psychology of trading. In the beginning, we analyzed the emotions that are most likely to influence trading performance: greed, fear, pride, and regret. Then, we went over the consequences of emotionally-driven trading activity: “selling winners, and holding onto losers”, revenge trading, and analysis paralysis. In the final part, we offered tips to help traders manage their emotions during their interactions with financial markets.

Further reading on the psychology of trading:

Brett N. Steenbarger, The Psychology of Trading: Tools and Techniques for Minding the Markets, Wiley Trading Series.

Nick Leeson and Ivan Tyrell, Back from the Brink: Coping with Stress, Virgin Books.

Shefrin and Statman (1985) ‘The Disposition to Sell Winners Too Early and Ride Losers Too Long: Theory and Evidence‘ Journal of Finance, Vol. 40(3), pp. 777-790.

what is next?

This lesson is part of our course on the fundamentals of trading.

- Previous lesson: We explained the notion of liquidity, covering its key dimensions.

We hope you’ve enjoyed this lesson on the psychology of trading. Feel free to browse other lessons included in this course. If you’ve got any questions or comments, you reach us through our contact form.