Tag: portfolio performance evaluation

-

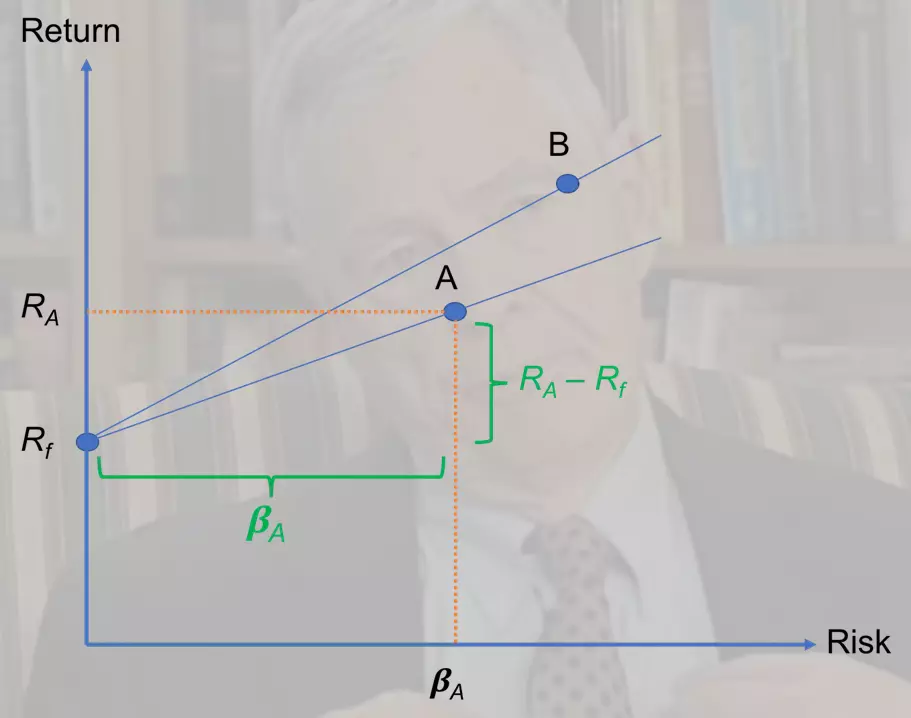

Treynor ratio formula, calculator

Treynor ratio is a popular risk-adjusted performance measure. It gets its name from the American economist Jack Treynor who came up with this measure in the mid-1960s (see the full reference at the end). It is a measure of how much “excess return” (i.e., return above the risk-free rate) a security (stock, bond, mutual fund, etc.)…

-

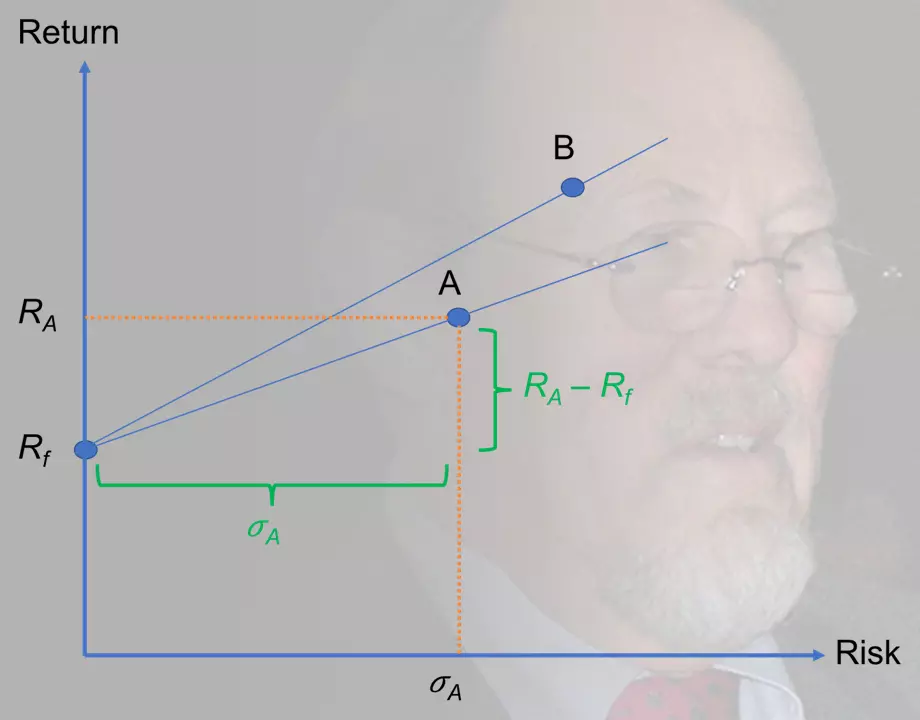

Sharpe ratio calculator, formula

Sharpe ratio is among the most widely used performance evaluation metrics in the fund management industry. It is a reward-to-risk ratio, such that it captures the (excess) return an asset (e.g., stock) generates per unit of (total) risk, which is measured by return volatility. It was developed by Nobel laureate William F. Sharpe, who is…

-

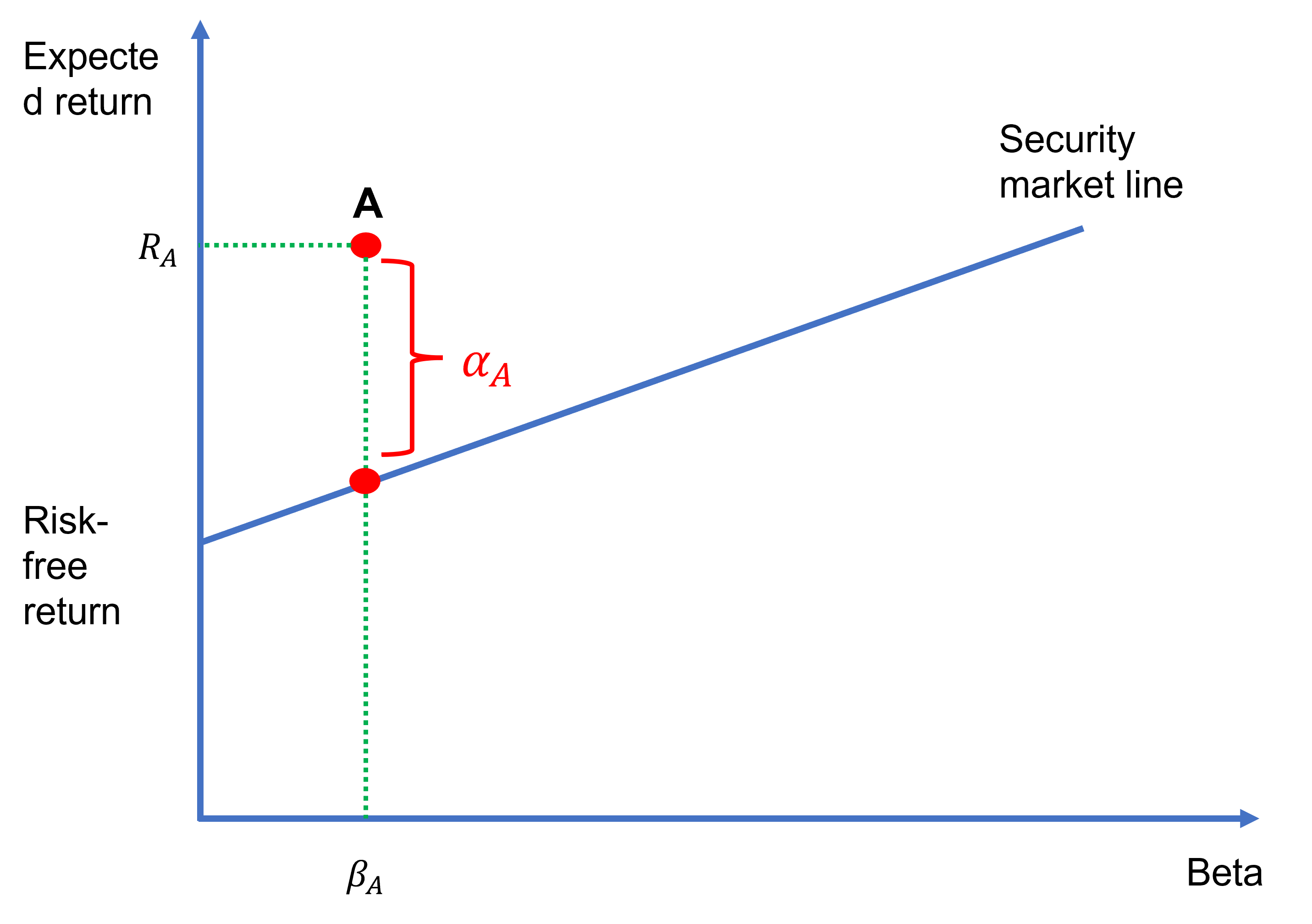

Jensen’s alpha formula and calculator

Jensen’s alpha is a popular performance evaluation metric, which was developed by the American financial economist Michael Jensen in the late 60s. It is a risk-adjusted performance measure (other examples include the Sharpe ratio and Treynor ratio) and is theoretically linked to the capital asset pricing model (or the CAPM). Jensen’s alpha formula We can…

-

Investments quiz – Test your knowledge!

in investmentsThis investments quiz aims to test your knowledge of the material covered in our free investments course. The quiz is a multiple-choice test. It consists of three sections: The solutions are provided at the bottom of this page. Section A: Return calculations 1. You buy a single share of a stock for $10. After three…