Category: trading basics

-

Psychology of trading

The psychology of trading encompasses the emotional states and moods that traders go through during their trading activities. Emotional trading can have an adverse impact on a trader’s performance, leading to mental issues as well as financial loss. Therefore, all traders should have at least a basic understanding of how emotions influence trading activity. We’ve…

-

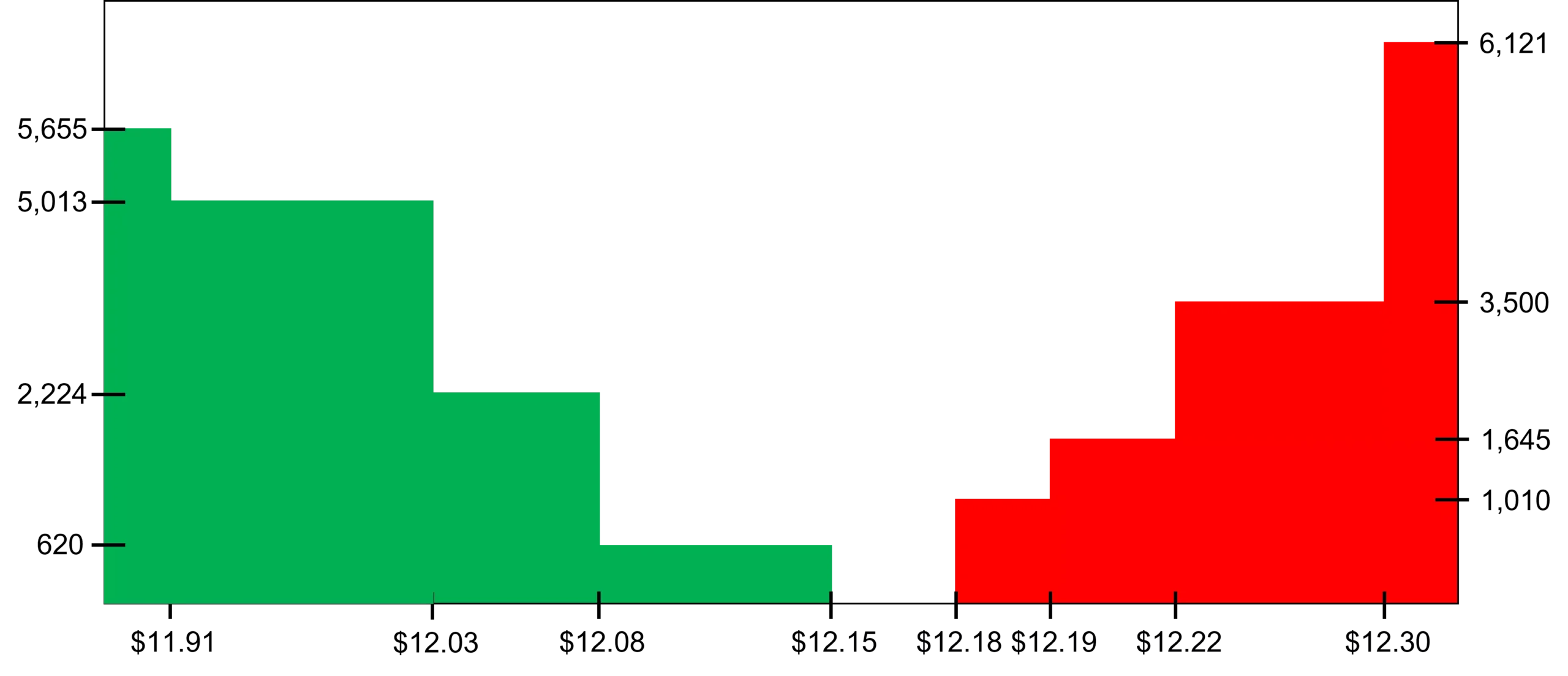

Limit order book

In a market setting, a limit order book for a particular security (e.g., a stock) is the collection of limit orders (both buy and sell) submitted by traders who are interested in trading that security. What does a limit order book look like? Figure 1 illustrates what a typical limit order book looks like. We…

-

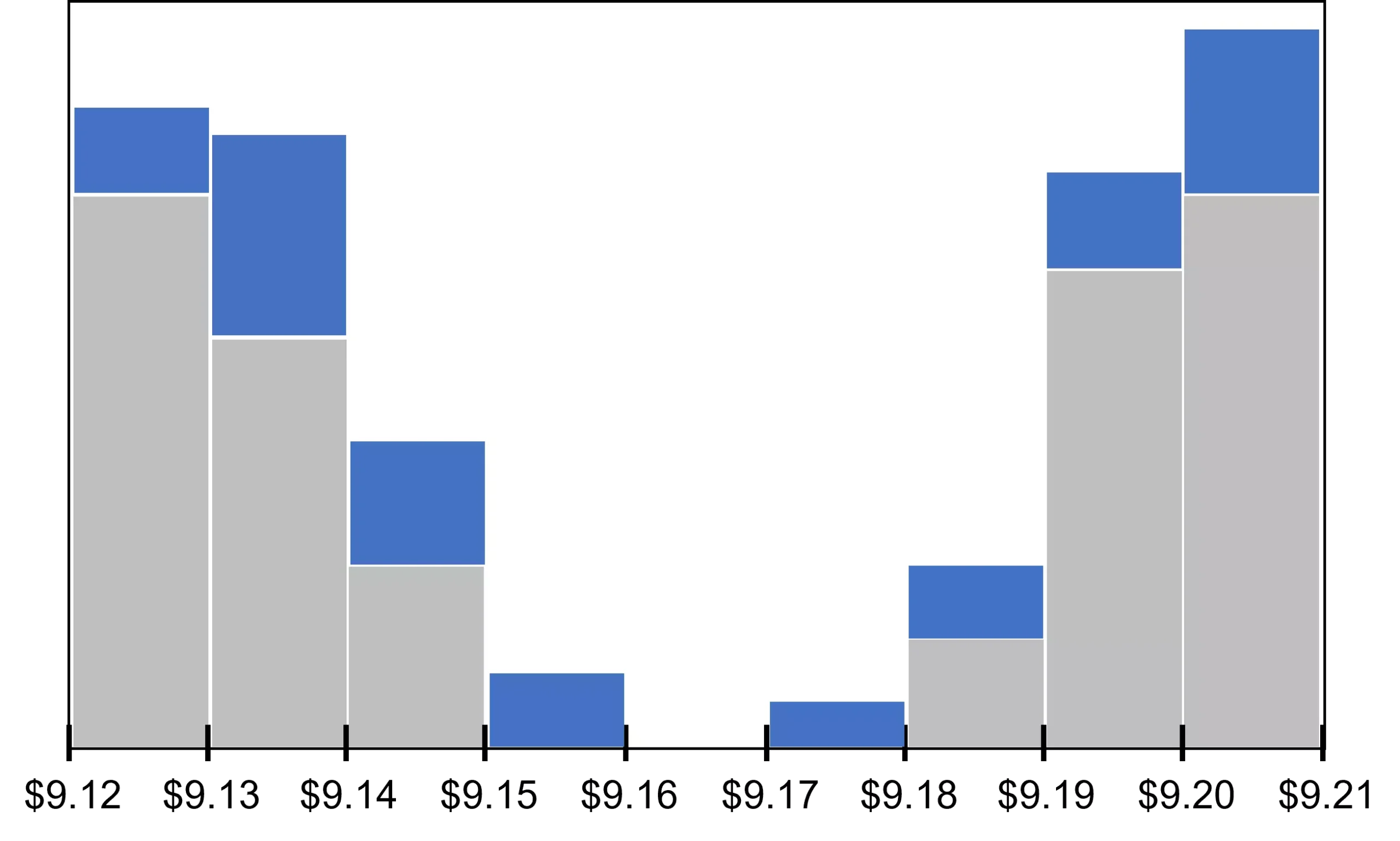

What is liquidity in stocks?

Liquidity is a fundamental concept in finance and trading. But, what is liquidity in stocks in particular and financial markets in general? A liquid stock can be traded easily in relatively large volumes without affecting its price in the market. In contrast, illiquid stocks are traded thinly, such that it may be difficult to find…

-

Arbitrage opportunity

An arbitrage opportunity arises when an asset is mispriced, giving traders a chance to make money. In the case of pure arbitrage, the opportunity carries no risk. The same can’t be said for statistical arbitrage and risk arbitrage, both of which involve risk. All forms of arbitrage opportunities are based on a buy low, sell…

-

Long position vs short position

It is easy for beginner traders to get lost when listening to conversations by seasoned traders. Trading involves lots of technical terms and specific jargon. For example, what does it mean to be “long” or “short” in a stock or option? This comes down to the following dichotomy: long position vs short position. In a…

-

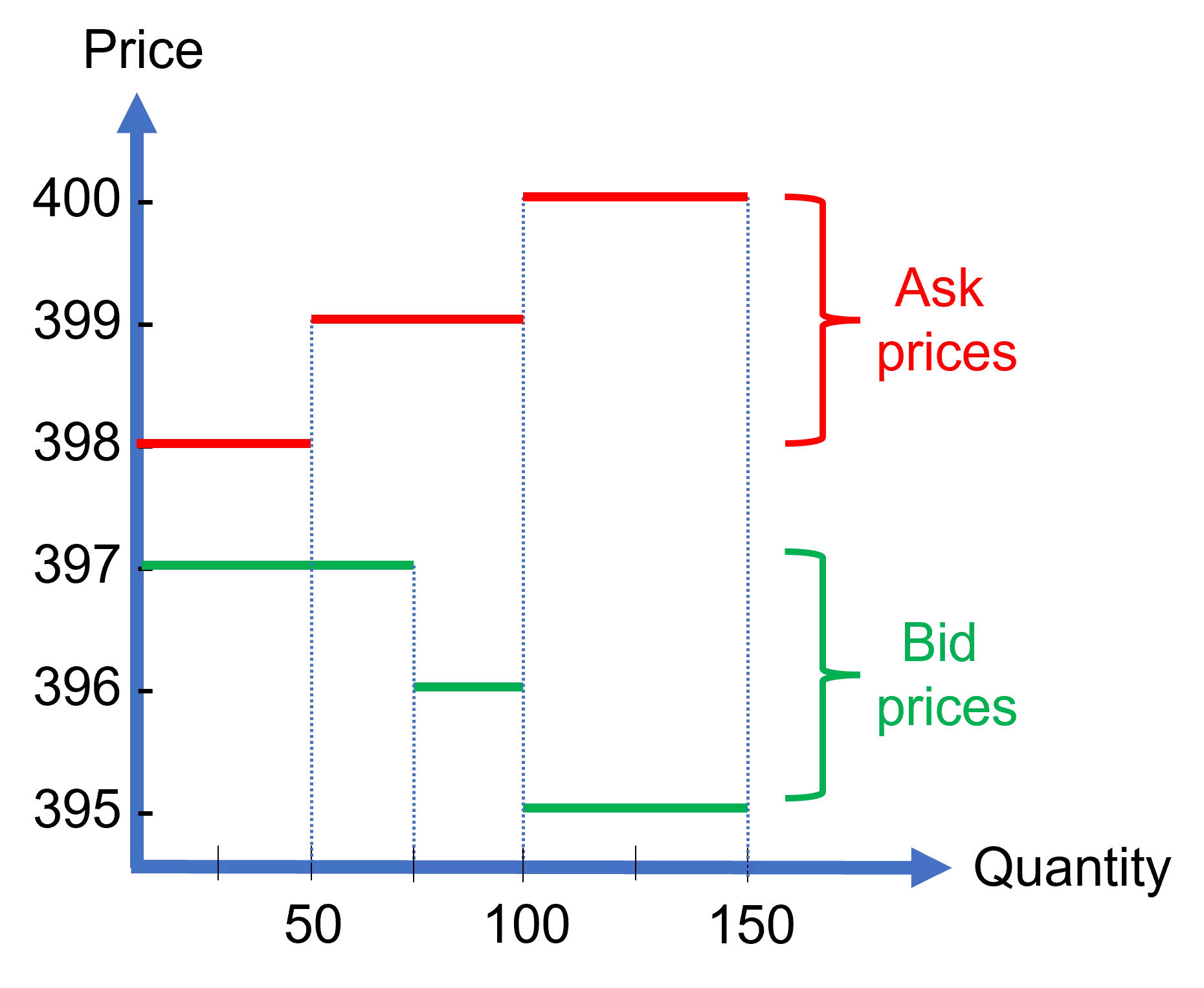

Bid price vs ask price

It’s easy for beginner investors to get confused about bid prices and ask prices (or offer prices). If that’s the case for you, try to remember the following: Bid is buy, ask is sell And, this is from the counterparty’s (e.g., dealer) perspective. So, if you would like to trade, say, a stock, the bid…

-

Market order vs limit order: Liquidity and uncertainty

Market order vs limit order? Let’s dive in! Imagine that you are in need of cash, and, for that reason, you need to sell some shares of a stock you own. What type of trade order should you submit to meet your liquidity needs? If your need for cash is urgent, what you need is…