Tag: portfolio

-

Idiosyncratic risk

Idiosyncratic risk is the type of risk that affects either a single security such as a stock or a small group of securities. This is in contrast to systematic risk, which affects all risky securities in a particular market. The word “idiosyncratic” is not commonly used in daily language. ln fact, idiosyncratic risk is often…

-

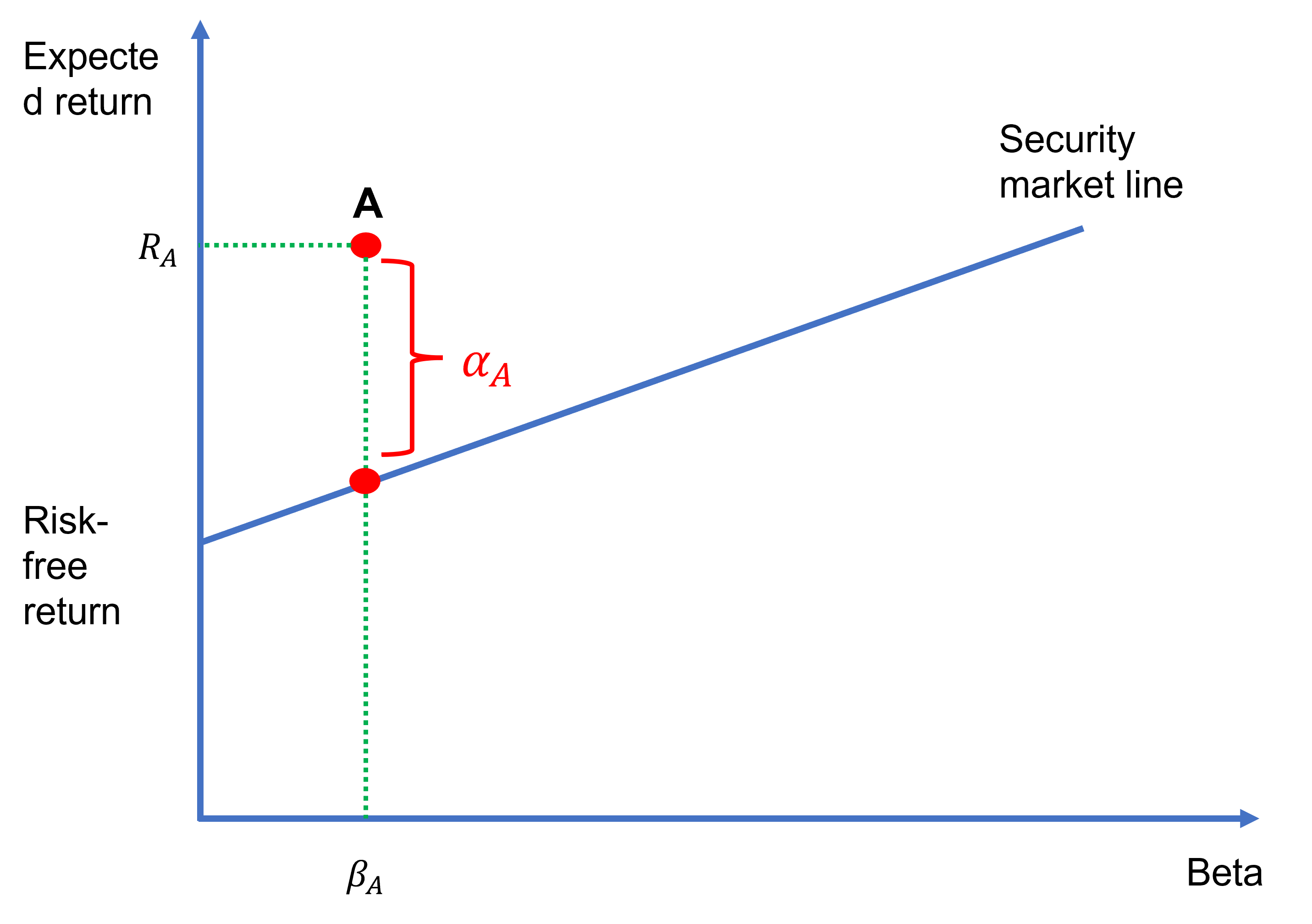

Jensen’s alpha formula and calculator

Jensen’s alpha is a popular performance evaluation metric, which was developed by the American financial economist Michael Jensen in the late 60s. It is a risk-adjusted performance measure (other examples include the Sharpe ratio and Treynor ratio) and is theoretically linked to the capital asset pricing model (or the CAPM). Jensen’s alpha formula We can…

-

Investments quiz – Test your knowledge!

in investmentsThis investments quiz aims to test your knowledge of the material covered in our free investments course. The quiz is a multiple-choice test. It consists of three sections: The solutions are provided at the bottom of this page. Section A: Return calculations 1. You buy a single share of a stock for $10. After three…

-

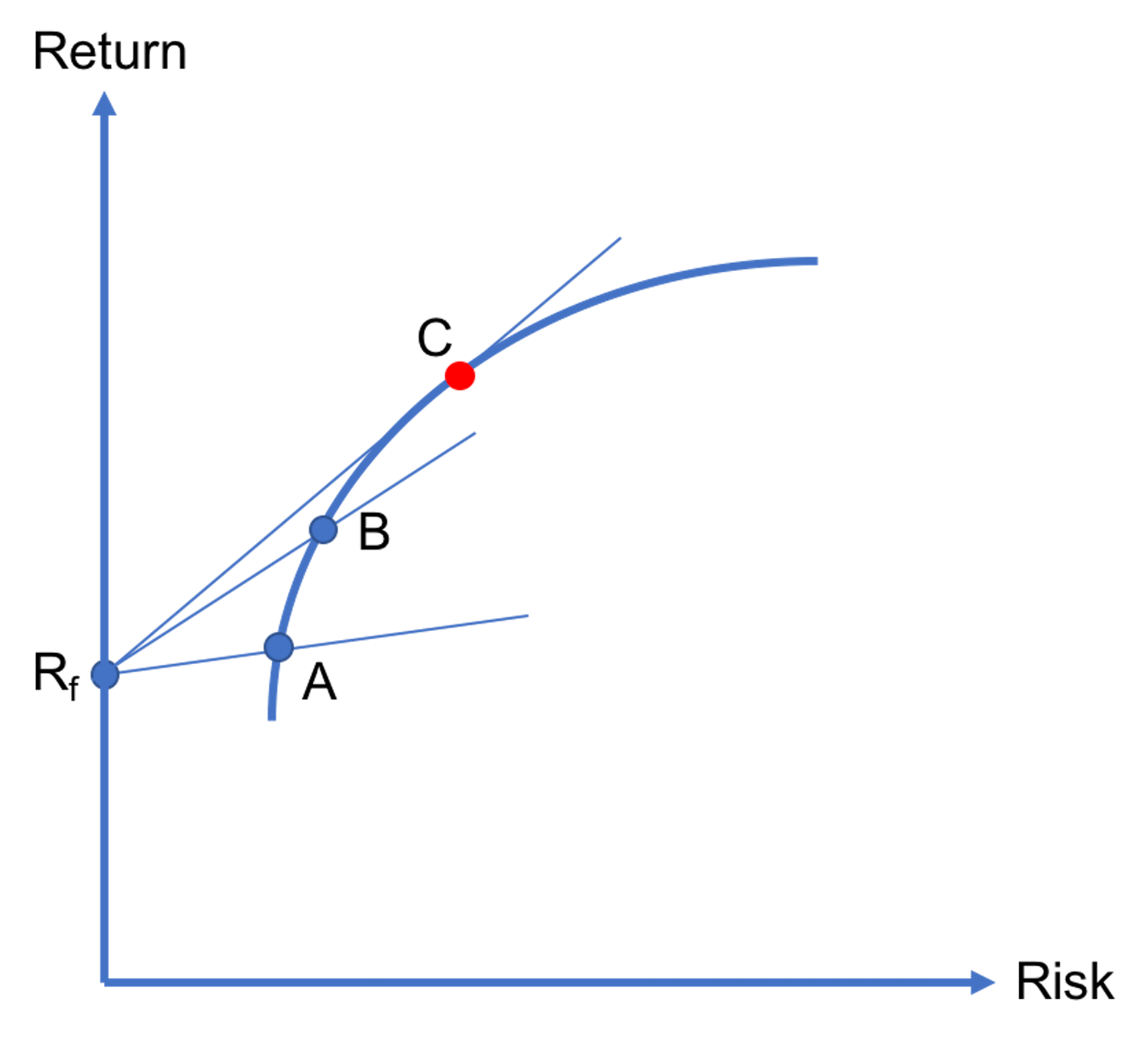

Optimal risky portfolio

In previous lessons, we explained that when there is no risk-free asset in an economy, investors should invest in one of the portfolios that lie on the efficient frontier based on their risk tolerances. But, if a risk-free asset exists, then there is a unique portfolio that all investors should invest in. In particular, the…

-

Portfolio return calculator and formula

In this lesson, we’ll teach you how to compute the return of a portfolio that consists of multiple assets. We offer a portfolio return calculator as well. Portfolio return calculator You can use the portfolio return calculator below to compute the returns of portfolios containing up to 5 stocks. Please note: Portfolio return formula So…