Tag: stocks

-

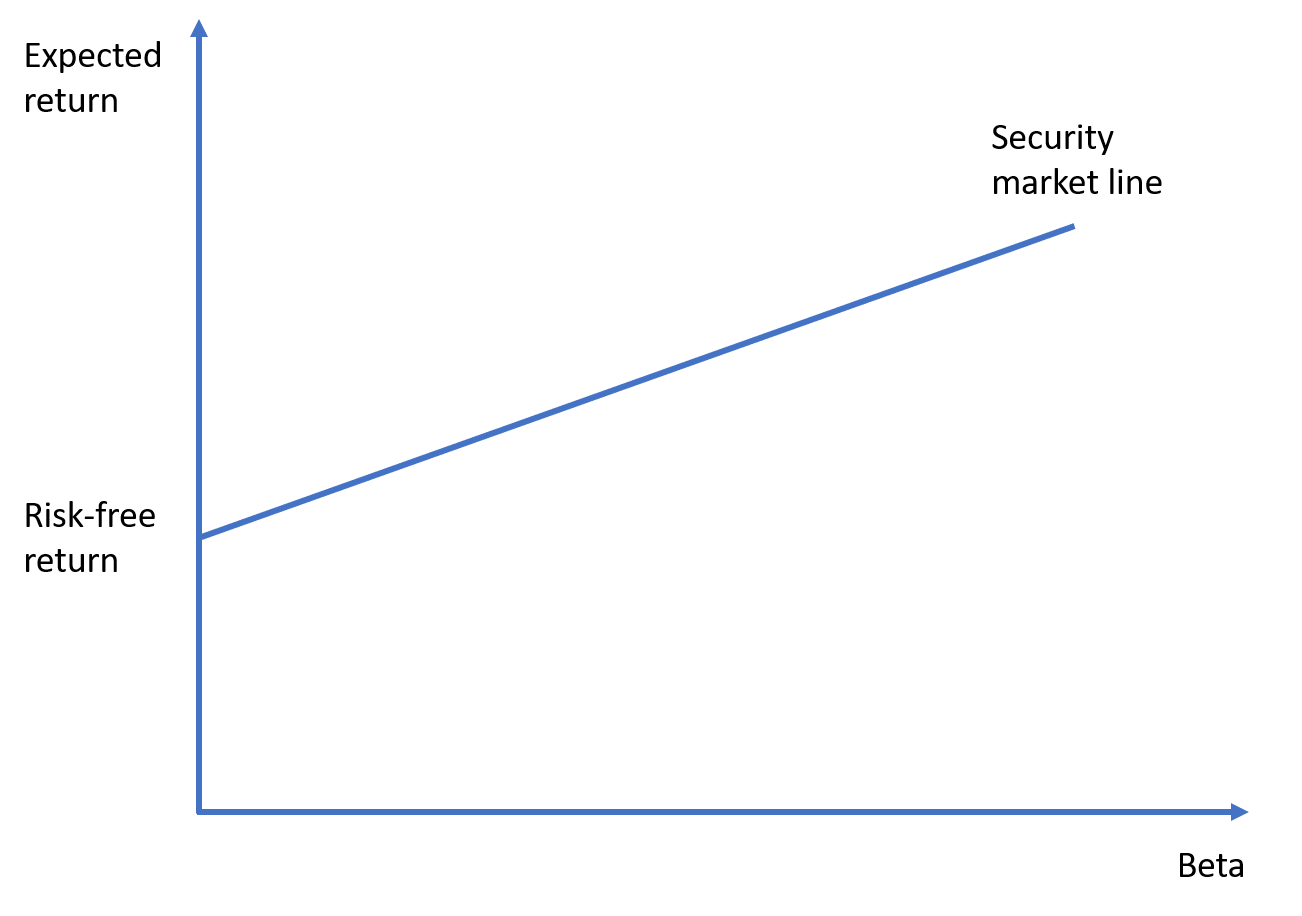

Capital asset pricing model (CAPM)

The capital asset pricing model (or CAPM) is among the most widely-used asset pricing models by stock analysts and portfolio managers. Its popularity arises from its simplicity and elegance. Analysts and investors can use it to forecast returns or to estimate the cost of equity. In this lesson, we explain this model and its assumptions.…

-

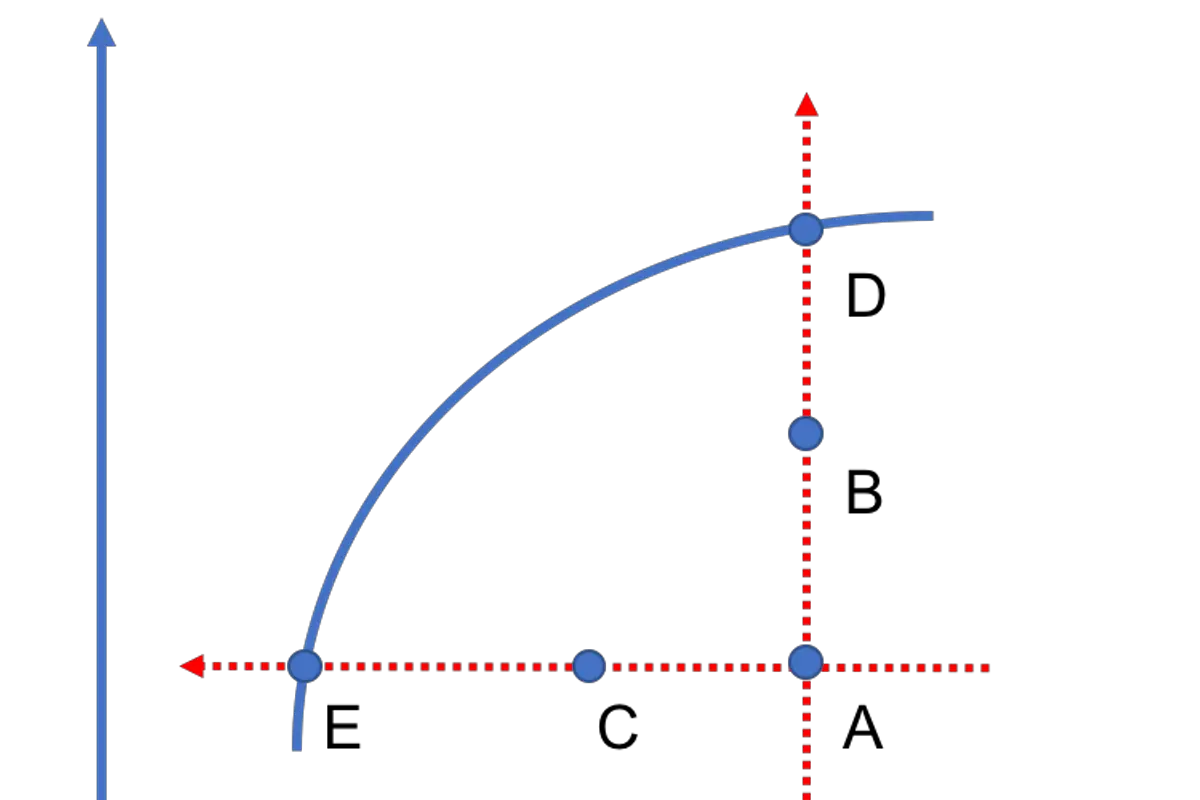

Minimum variance portfolio

In this lesson, we explain what is meant by the minimum variance portfolio (MVP), derive its formula for the two-asset case, and provide an online calculator as well. You can also check out our video tutorial to learn how to find the position of the MVP on the efficient frontier using Excel’s solver tool. And,…

-

Efficient frontier calculator

In modern portfolio theory, the efficient frontier represents the collection of all efficient portfolios within a market. Efficient portfolios offer the best risk-return tradeoff and, as such, are superior to inefficient portfolios, which are suboptimal. In this lesson, we explain how investors can trace the efficient frontier using mean-variance optimization (the topic of the previous…

-

Return volatility formula and calculator

The topic of this lesson is the return volatility of risky assets such as stocks, mutual funds, etc. We will explain how to measure it and provide a calculator as well. What is (stock) return volatility? Imagine an investor who bought shares of a stock three years ago. According to the investor’s calculations, her annual…

-

Geometric average return calculator and formula

In this post, we explain the geometric average return formula using numerical examples and discuss how it differs from the arithmetic average return. We provide a practical geometric average return calculator as well. Geometric average return formula The geometric average return formula can be written as follows: While the formula looks complicated at first sight,…

-

Investments quiz – Test your knowledge!

in investmentsThis investments quiz aims to test your knowledge of the material covered in our free investments course. The quiz is a multiple-choice test. It consists of three sections: The solutions are provided at the bottom of this page. Section A: Return calculations 1. You buy a single share of a stock for $10. After three…

-

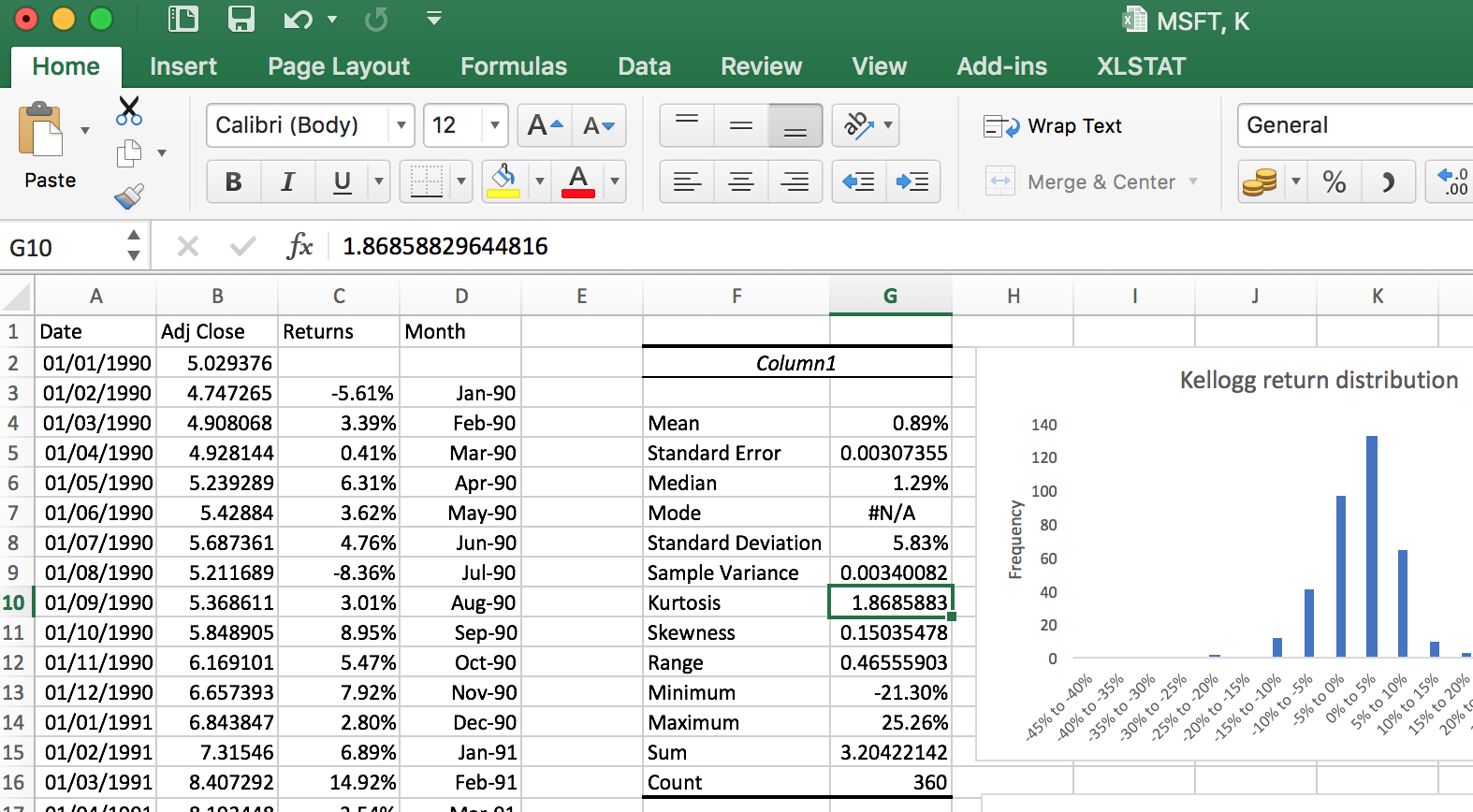

Descriptive statistics for stock returns

Descriptive statistics offer a simple way of understanding distributions of stock returns. They give us an idea about a distribution’s centrality, dispersion, and other features. In this tutorial, we will show you how to generate descriptive statistics for stock returns using Excel’s data analysis tool. Using Excel to get descriptive statistics for stock returns What…

-

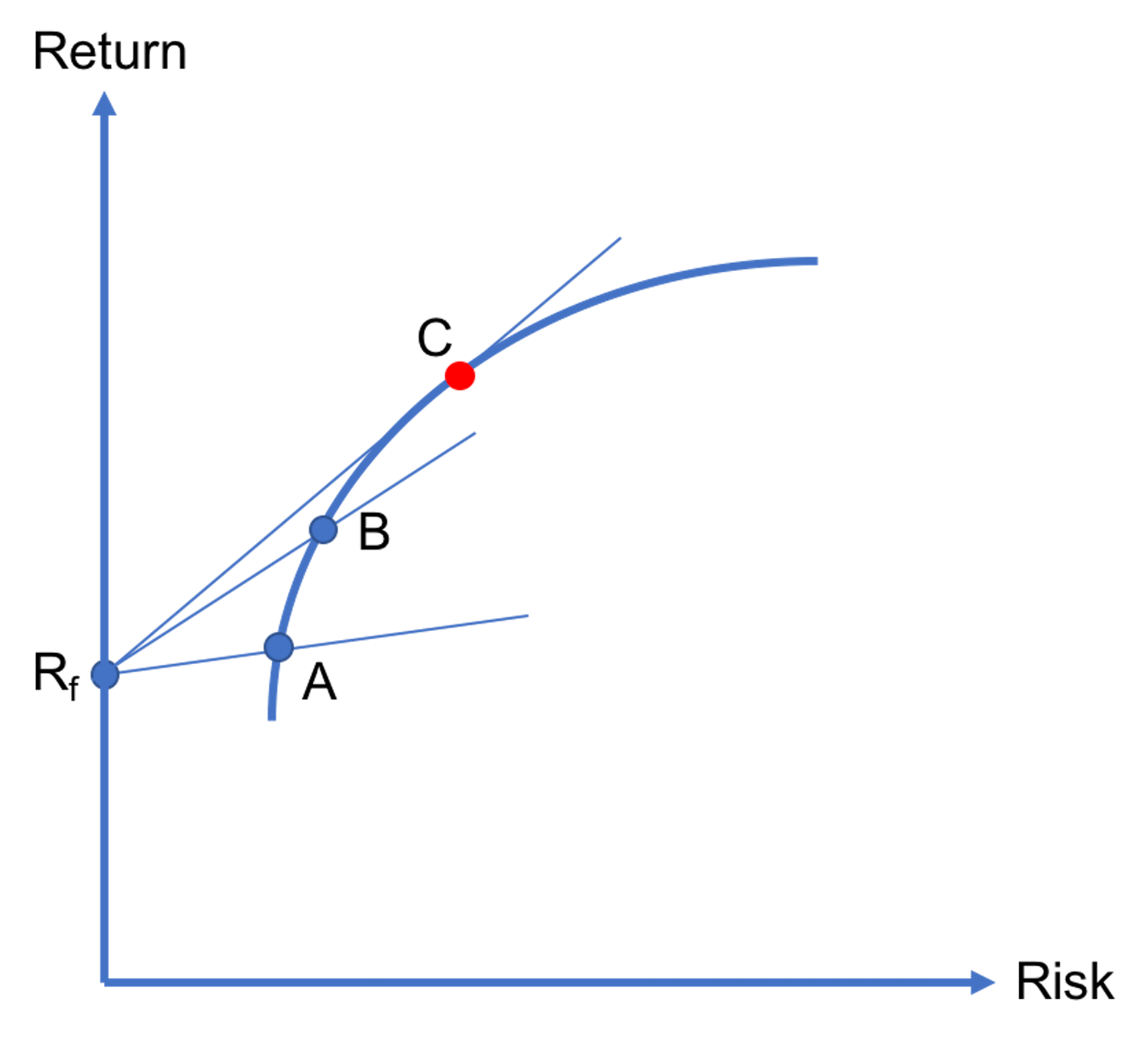

Optimal risky portfolio

In previous lessons, we explained that when there is no risk-free asset in an economy, investors should invest in one of the portfolios that lie on the efficient frontier based on their risk tolerances. But, if a risk-free asset exists, then there is a unique portfolio that all investors should invest in. In particular, the…

-

Portfolio return calculator and formula

In this lesson, we’ll teach you how to compute the return of a portfolio that consists of multiple assets. We offer a portfolio return calculator as well. Portfolio return calculator You can use the portfolio return calculator below to compute the returns of portfolios containing up to 5 stocks. Please note: Portfolio return formula So…

-

Expected return calculator and formula

We can rely on the historical (or realized) average return when evaluating an asset’s past performance. In that sense, the historical average return is a backward-looking measure. But, to forecast an asset’s future performance, we need a forward-looking measure. This measure is called the expected return. In this lesson, we explain how to compute the…