Welcome to your home of financial education

Initial Return is a collaborative effort between finance professionals, academics, and investors. We produce high-quality educational content for investors, traders, and finance students.

Browse our free courses and tutorials

Watch our educational videos

We have an active YouTube channel offering video tutorials on a wide range of topics in finance, investments, and trading. Click the button below to visit our channel or watch one of our popular videos featured below.

Explore a wealth of free resources

You’ll find numerous useful tools and templates on our webpages. What’s more, our content is prepared by finance academics and professionals with finance students and beginner investors in mind.

Easy-to-use online calculators

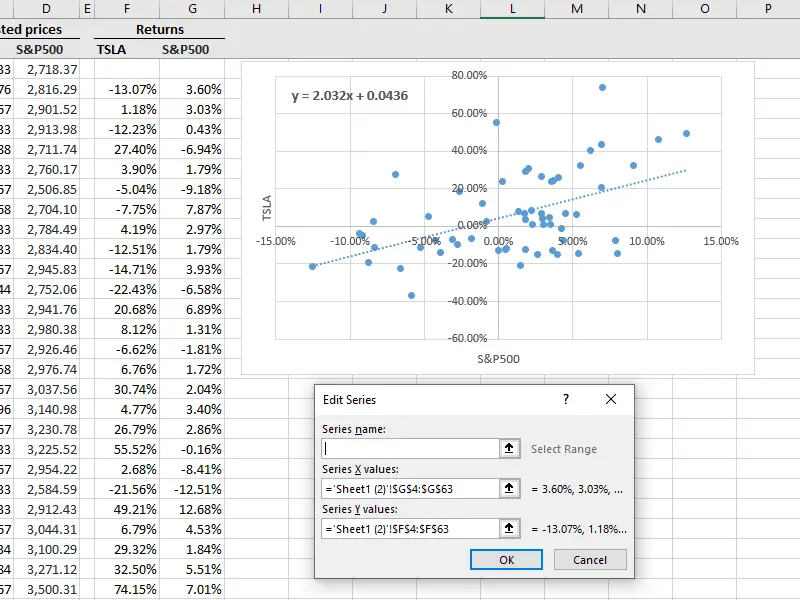

Free Excel templates

“Financial education is the passport to a world where financial freedom is not just a destination, but a journey of empowerment and informed choices.”

Initial Return

The home of financial education